Why I Increased My ServiceNow Position

Behind My Latest Buy: AI Growth, Recurring Revenue, and Execution Strength

CMQ Investors,

I aim to be 100% transparent about my investment decisions. In my April 12, 2025 portfolio update, I shared that ServiceNow made up 1.6% of my stock portfolio. This past week, I used available cash in my Roth IRA to increase the position to 2.2%.

Want to know why? Keep reading.

Enterprise AI Spending: A Major Tailwind

One of the lessons your management has learned—and, unfortunately, sometimes re-learned—is the importance of being in businesses where tailwinds prevail rather than headwinds. —Warren Buffett

Right now, enterprise AI adoption is one of the clearest tailwinds. In 2025, global enterprise tech spending is projected to hit $4.9 trillion, with AI as a major driver.

For those interested, I created a short report using Perplexity. Tap the button below to download.

A Sticky, Subscription-Based Business

ServiceNow earns almost all of its revenue from subscriptions.

Subscription revenue grew 19%, reaching $3.01 billion in Q1 2025.

This is strong, double-digit growth for an already-large business.

The subscription business is growing and it’s extremely sticky. Renewal rates are nearly 100%.

Our renewal rate remained best-in-class at 98%, underscoring the consistent value that ServiceNow delivers to our customers. —Gina Mastantuono, CFO

High retention signals product stickiness, customer satisfaction, and embedded value. Most importantly, it gives me more certainty as a long-term investor.

More Metrics That Matter

Gross Margin: 79%

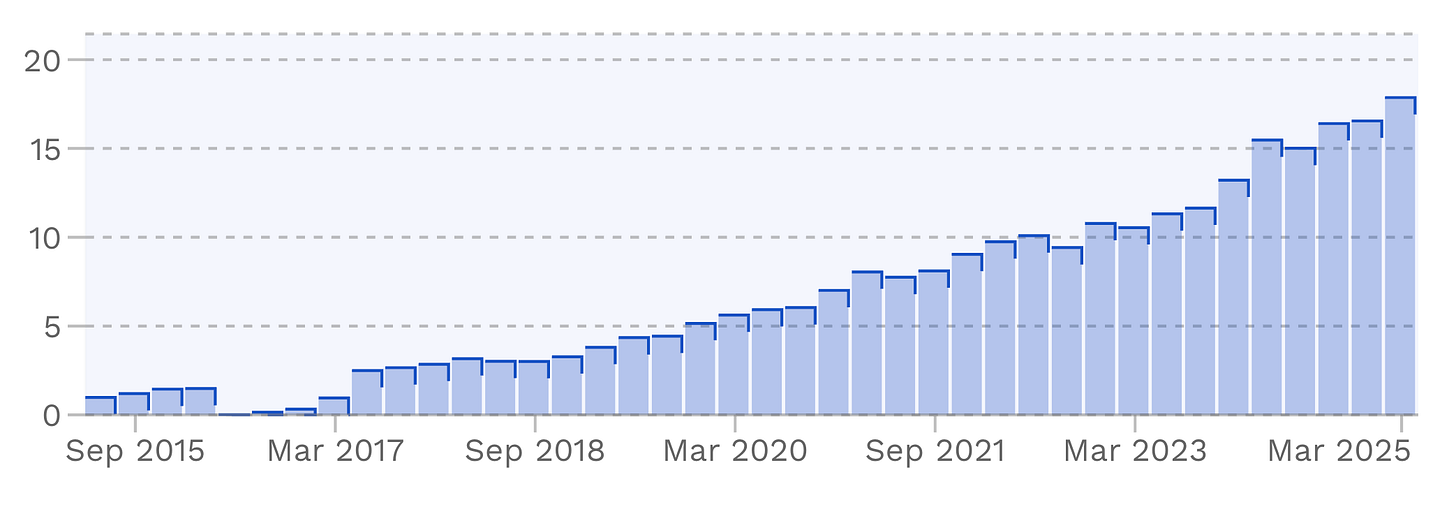

Free Cash Flow: $1.48B, up 21% YoY

Remaining Performance Obligations (RPO): $22.1 billion (up 25% YoY)

RPO refers to all the revenue ServiceNow is contractually guaranteed to receive in the future from its current customer contracts.

It’s a leading indicator of future revenue and cash flow.

Strong RPO growth suggests high customer confidence and long-term commitment.

High-Value Customers: 508 with >$5M in ACV (up from 425 YoY)

That’s a 19.5% YoY increase in big-ticket customers—proof of deepening enterprise trust.

The Ultimate Measure of Value

What matters most is that ServiceNow grows free cash flow per share. If ServiceNow keeps increasing this number, long-term investors win—even if the stock price is volatile short-term.

Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share….earnings don’t directly translate into cash flows, and shares are worth only the present value of their future cash flows, not the present value of their future earnings. —Jeff Bezos (2005)

Final Thoughts

ServiceNow’s Q1 earnings didn’t shift my thesis. It reinforced it.

Execution is strong. Guidance accounts for macro uncertainty, but pipeline momentum and federal demand provide ballast.

Buying more shares below my average cost basis just made sense.

Subscribe to see how my ServiceNow investment plays out.

Become a free subscriber to get investing insights delivered straight to your inbox—plus instant access to our full library of investing PDFs.

Thank you for supporting CMQ! If you enjoyed reading this post, feel free to share it with friends. Or feel free to click the ❤️ button on this post so more people can discover it on Substack.

🎧 Listen to the CMQ Investing Podcast for Free on Spotify or Apple Podcasts