Warren Buffett's Apple Position Is Now 51% of His Portfolio

Learn what Buffett's investment reveals about identifying the 'best business' opportunities.

Dear CMQ Investors,

Today, let's delve into a fascinating topic that can offer us profound insights into successful investing: Warren Buffett's concentrated investment in Apple.

Warren Buffett's Big Bet on Apple

Did You Know: that over 50% of the portfolio managed by Warren Buffett for Berkshire Hathaway is invested in Apple?

This strategic decision, initiated in Q1 of 2016 when Apple was in a “slump” , has proven to be one of his most lucrative investments.

What Makes a Great Business? According to Warren Buffett, the best business is one that not only generates significant cash flow but can also reinvest it efficiently for more capacity.

Key Metrics: High returns on capital, low capital expenditures, and substantial free cash flow are the hallmarks of such a business.

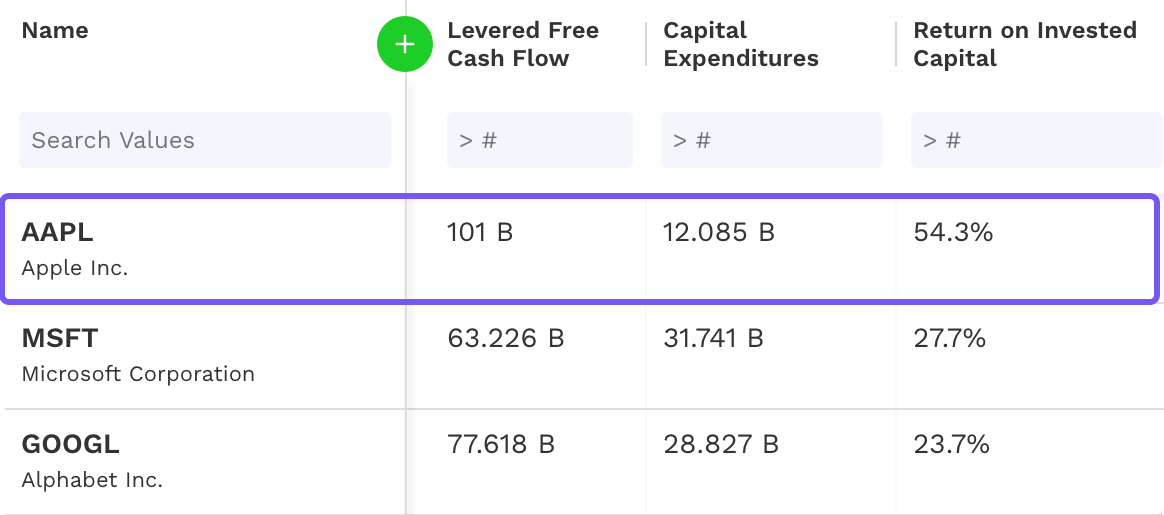

Let's examine Apple's financials through Buffett's lens:

Free Cash Flow: Over $100 billion

Capital Expenditures: $12 billion

Return on Invested Capital: 54%

Shareholder Value Creation: Apple’s use of its cash flow for dividends and buybacks further enhances shareholder value.

Since 2012, the company has spent over 573 billion on share repurchases.

This makes Apple a "compounding machine," consistently creating value for its shareholders through dividends and share buybacks.

Analogy: The synthesis of high returns on capital, low capital expenditures, and abundant free cash flow forms a "Lollapalooza effect," propelling a company's growth and enhancing shareholder value.

Actionable Insights

Seek Financially Robust Companies: Like Apple, companies with strong free cash flow and solid returns on invested capital are generally stable investments.

Value Over Price: A high-quality company at a fair price is preferable to a mediocre one at a bargain.

Diversification vs. Concentration: Understand your risk tolerance before considering a concentrated position like Buffett's in Apple.

Time-Tested Wisdom: Warren Buffett's investment approach, focusing on long-term value, quality at reasonable prices, understanding consumer behavior, and strong leadership, continues to be relevant in today's investment landscape.

📢 Community Announcements

I will be creating more in-depth content about Apple’s for our Paid Members in the coming weeks.

Apple’s conference call to discuss fourth fiscal quarter results and business updates is tonight at 5:00 p.m. ET.

📝 Your Feedback Matters