🟢 Diversification Guide: What Buffett, Munger, & the best investing minds think about diversifying

Diversification Guide

This is a free version of our guide to diversification. Paid subscribers will receive the complete version on Monday, March 22nd. It has 2.5x more content. 📖 Definitions

“Investing in a variety of securities.” —Dictionary

“Diversification helps you manage risk in investing” —Bankrate

“A risk management strategy…” —Investopedia

“An investing strategy used to manage risk.” —Forbes

“A risk management strategy…” —Robinhood

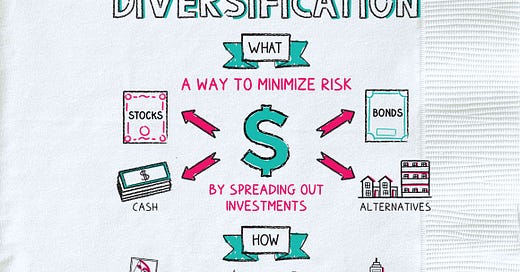

📸 Visual Explanation

I found this explanation of diversification via Napkin Finance

🟢 Why It Works

💬 John Templeton: “If you have your wealth in one company, unexpected troubles may cause a serious loss; but if you own the stocks of 12 companies in different industries, the one which turns out badly will probably be offset by some other which turns out better than expected.”

💬 Peter Lynch: “…it isn't safe to own just one stock, because in spite of your best efforts, the one you choose might be the victim of unforeseen circumstances.”

💬 Ray Dalio: “Diversification can improve your expected return-risk ratio by more than anything else you can do. That’s because while you can’t know which of the items you are betting on will provide better results, you do know that they will behave differently, and by mixing them appropriately you can reduce risk.”

🔴 Counter Arguments

💬 Phil Fisher: “Investors have been so oversold on diversification that fear of having too many eggs in one basket has caused them to put far too little into companies they thoroughly know and far too much in others about which they know nothing at all. It never seems to occur to them, much less to their advisors, that buying a company without having sufficient knowledge of it may be even more dangerous than having inadequate diversification.”

💬 Warren Buffett: “There is less risk in owning three easy-to-identify, wonderful businesses than there is in owning 50 well-known, big businesses.”

💬 Charlie Munger: “The idea that very smart people with investment skills should have hugely diversified portfolios is madness. It’s a very conventional madness. And it’s taught in all the business schools. But they’re wrong."

👉 Best Example: Index Funds

Broad diversification is one of the key attributes index funds like the VTSAX.

3633 holdings = 100% of total net assets

Ten largest holdings = 22.60% of total net assets

Guaranteed to do no better (or worse) than average

Remember: Most investors achieve less-than-average results.

📚 Read more about indexing here.

🎯 Alternative: Focus Investing

What is focus investing?

“…the heart of focus investing [is] concentrating your investments in companies that have the highest probability of above-average performance.”

💬 John Maynard Keynes: “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.”

📚 Read more about focus Investing here.

🔗 Links

Diversification: What It Is and How to Apply It —Dave Ramsey

Here’s why diversification can be an investor’s worst enemy — CNBC

How to diversify — J.P.Morgan

How to diversify your portfolio to limit losses and guard against risk — Insider

🔐 Paid subscribers will get access to the complete guide on Monday. Here is what you can expect.

2.5x more content

More Quotes, Videos, Links, Visuals

Related Mental Models 🧠

It answers the question: How many stocks should be in my portfolio?

Also includes my personal take 🔥

📝 Your feedback helps us improve. Take our short Typeform survey.

If you just want to say hello, send me a message: franco [at] cmqinvesting [dot] com.

📺 Related Video

I made this video (below) of Warren Buffett and Charlie Munger sharing their thoughts on diversification using clips from 1996, 2008, and 2020.

💬 Warren Buffett: "Wide diversification is only required when investors do not understand what they are doing."

💬 Charlie Munger: "Diversification is for the know-nothing investor; it’s not for the professional."

👉 Remember This: Buffett is adamant that there is nothing wrong with diversification if you do not know how to value a business.