John C. Bogle wrote The Little Book of Common Sense Investing to “change the very way that you think about investing.” While I would not say that The Little Book of Common Sense Investing is an ‘enjoyable’ read—Bogle proves, without a reasonable doubt, the merits of index investing. Furthermore, there is an essential takeaway from the book (outlined in this post) that is important for all investors to know and internalize.

This is the fourth edition (#004) of our Investing Book Notes series.

All quotes come from The Little Book of Common Sense Investing unless otherwise noted.

1. Who is John Bogle?

The book’s author, John Bogle, is the pioneer of indexing:

Born in 1929 in New Jersey; passed away in 2019.

Founder and CEO of The Vanguard Group

Bogle lived through the Great Depression

"One of the four investment giants of the 20th century"

—Fortune (1999)Warren Buffett on Bogle: “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle.” —Berkshire Hathaway Shareholder Letter (2016)

2. What is an index fund?

When you own stock, you own a piece of a business.

When you own an index, you own a piece of all the businesses.

“The index fund is simply a basket (portfolio) that holds many, many eggs (stocks) designed to mimic the overall performance of the US stock market (or any financial market or market sector).”

A traditional index fund (TIF) like the S&P 500 Index “owns shares of the dominant firms in corporate America, buying an interest in each stock in the stock market in proportion to its market capitalization, and then holding it forever.”

Warren Buffett advises most investors — including LeBron James — to make monthly investments in a low-cost index fund like the VTSAX.

“…owning a piece of America diversified piece bought over time held for 30 or 40 years — it's bound to do well and the income will go up over the years and there's really nothing to worry about…nobody's ever followed that and gotten other than a decent result.” —Warren Buffett

3. What is the key takeaway from Bogle’s book?

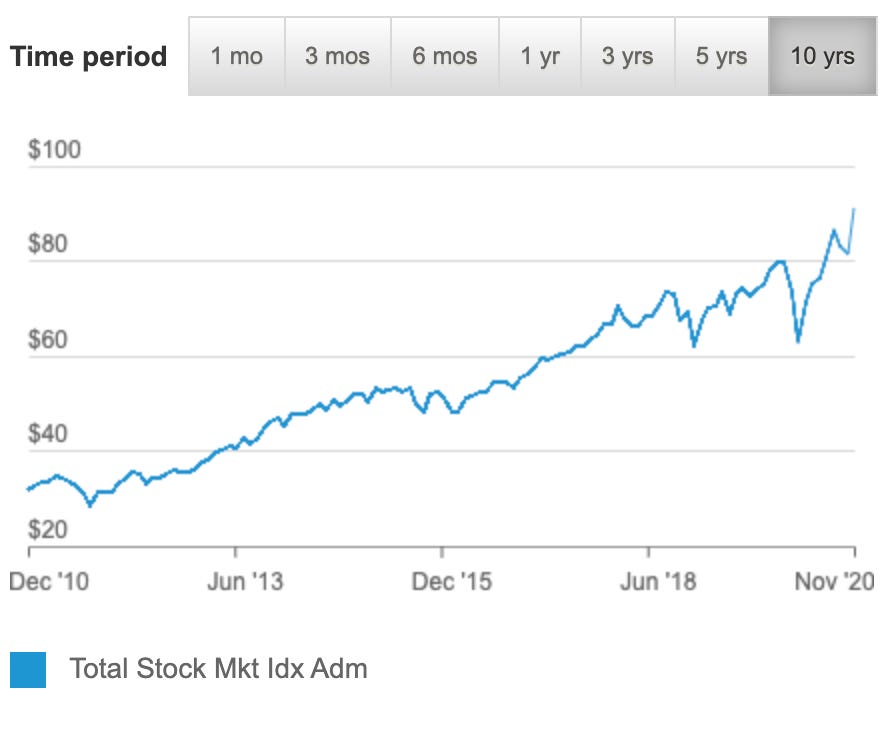

As a rational, long-term investor, your goal is to create a compounding machine. If you can achieve average annualized returns over a long investing lifetime, you will likely become wealthy.

“Thanks to the miracle of compounding, the accumulations of wealth that are generated by those returns over the years have been little short of fantastic.”

Average is not appealing. We want to do better than average. Bogle makes a bulletproof argument that by attempting to do better than average, the vast majority of investors get below-average returns over their lifetime.

🔑 — Beating the stock market is a loser’s game

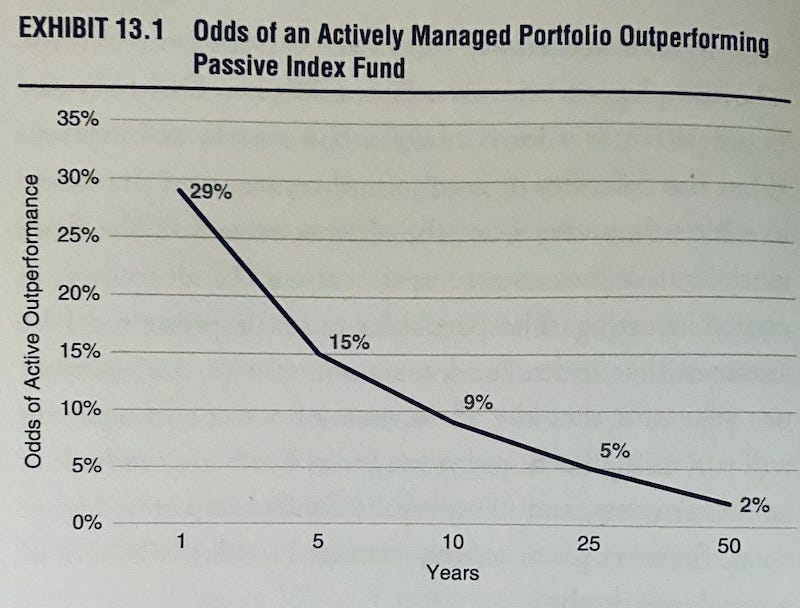

For starters, the vast majority of active investors are unable to out-perform the index.

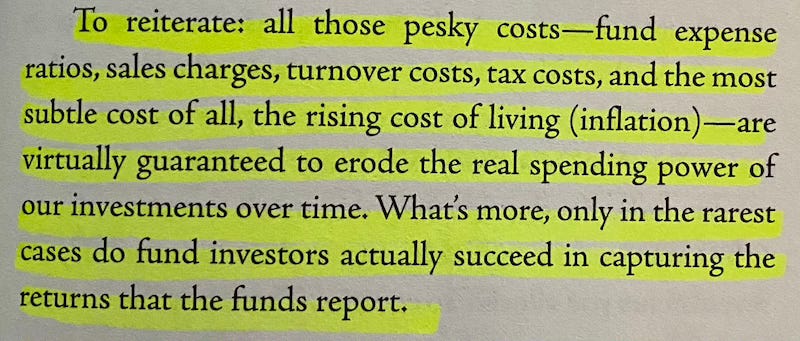

Even if you invest your money with someone who can achieve alpha, the cost of investing makes it nearly impossible to do better-than-average.

Bogle proves that in the aggregate, money managers delete value for investors. Active investing come with costs. And when you subtract these costs from your returns, you are bound to under-perform the index.

These management fees and expenses may seem small when viewed yearly or quarterly. However, as the image below illustrates, these ‘small’ fees take a big chunk out of your long-term wealth due to the power of compounding.

4. Why was indexing controversial?

Given the current popularity of indexing, I found it interesting to learn about how the idea was met with disdain from the investing community. Like many innovators before him, Bogle had to go against-the-grain to make his mark.

Mr. Bogle brought index investing to the individual investor in 1976 when Vanguard introduced the First Index Investment Trust. Ridiculed as "un-American" and "a sure path to mediocrity," the fund collected a mere $11 million during its initial underwriting. —Vanguard

“In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.” —Warren Buffett

A theme that is emerging from my reading is the importance of challenging the conventional wisdom. The great investors did this in some form or fashion, and Bogle is no exception.

“New ideas that fly in the face of the conventional wisdom of the day are always greeted with doubt and scorn.”

Final Thoughts

This quote says it best:

“Gunning for average is your best shot at finishing above average.”

I am not a financial advisor and you should do your own research.

Full transparency: Approximately 50% of my portfolio is in Vanguard index funds.

💰 Bonus Content

If you are one of the 37,000 people who follow our Instagram handle @CharlieMungerQuotes then you know Charlie believes index investing is for the “know-nothing” investor. But this isn’t an insult. To be a know-something investor requires a considerable amount of time; time which most cannot spare.

The caption comes from one of our followers (a professional investor):

“For 99% of people, buy a US equity index fund. Add to it every single month and never sell it - is the best advice to give people. Adding to it every month is key. This reiterated many of Charlie’s points - it’s time arbitrage. It will go up over time. Be patient and just add to it in a regular systematized way. Ending up wealthy really is that easy.”