My Portfolio Allocation: Recent Changes and Reasoning

Why 68% is in Index Funds and Other Investment Choices Explained

I recently made some adjustments to my stock portfolio. As always, I want to be transparent with you about how I am investing…

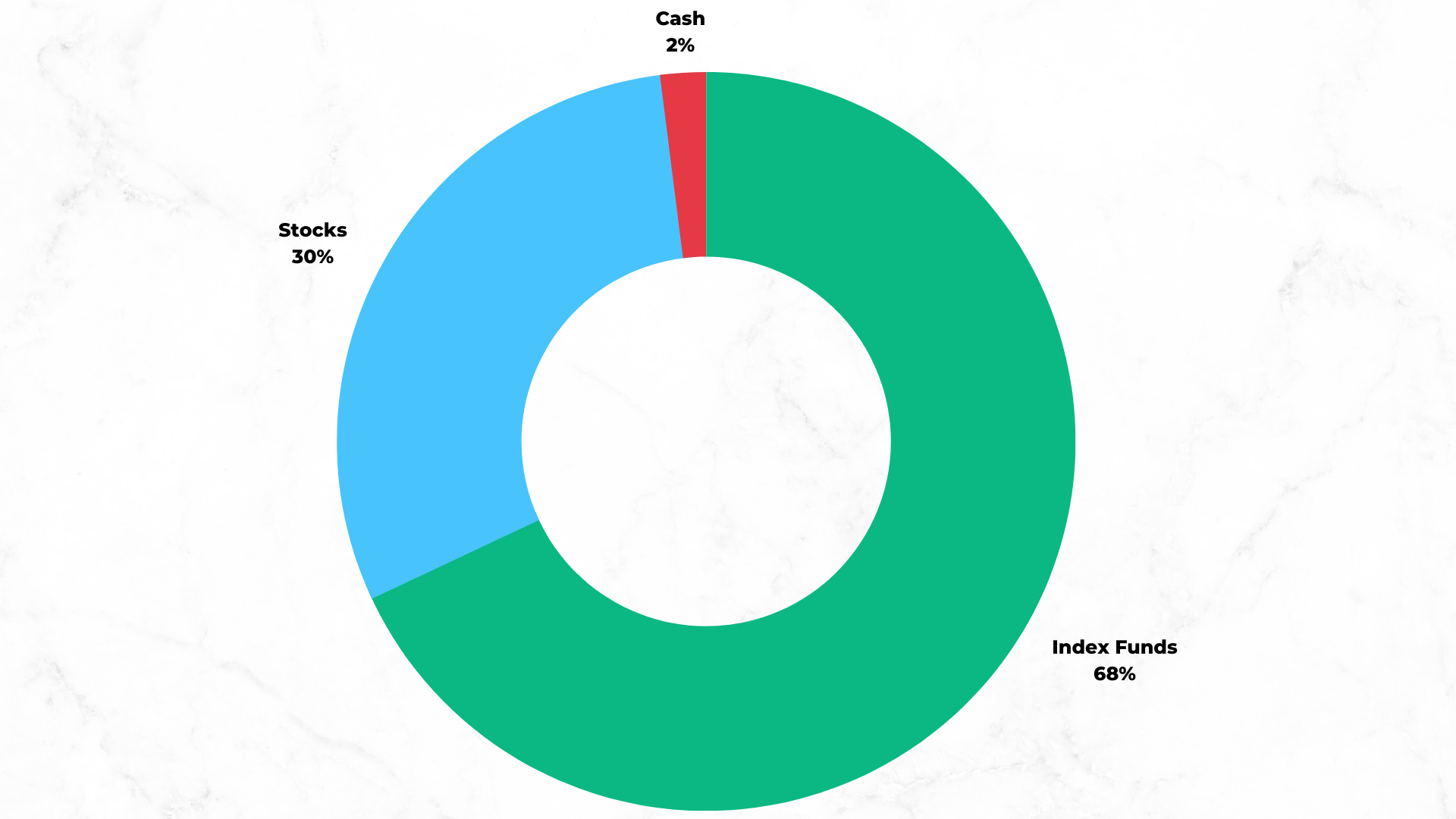

My Current Portfolio Allocation

The pie chart (below) represents both my brokerage and retirement accounts.

Index Funds - 68%

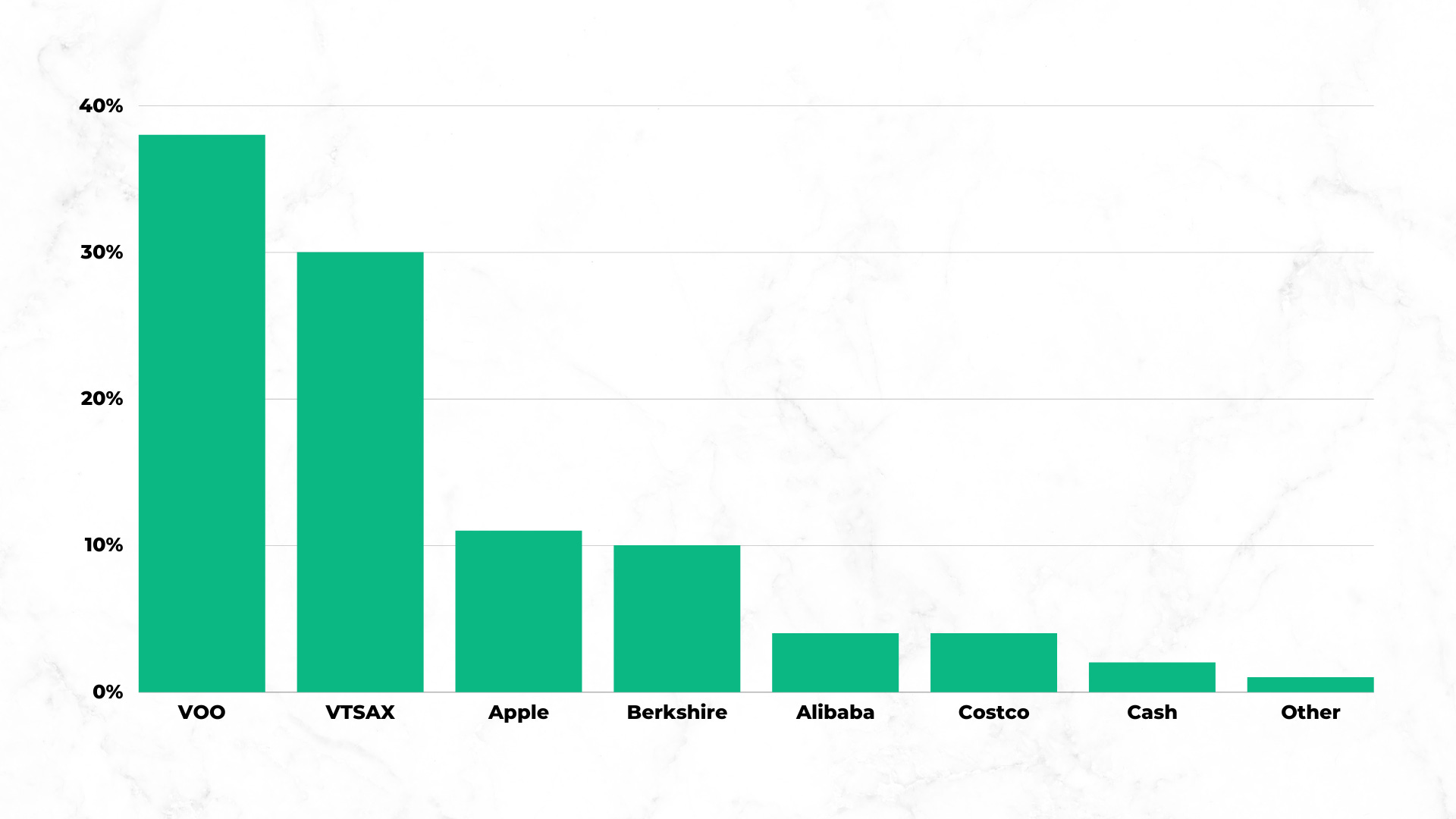

As of today, 68% of my portfolio consists of low-cost index funds, specifically Vanguard’s VOO and VTSAX.

The percentage of my total portfolio that is in low-cost index funds has been growing over the years. My aim is 70%.

Over a 30 year period, the average equity investor underperforms the S&P 500 by ~3% points. I concentrate in low-cost index funds to hedge against this.

Individual Stocks - 30%

Nearly 100% of my individual stock exposure come from four businesses.

Apple (AAPL) — 11%

First Purchased: December 23, 2014 (+506%)

Berkshire Hathaway (BRK-B) — 10%

First Purchased: July 28, 2020 (+82%)

Alibaba (BABA) — 4%

First Purchased: January 31, 2021 (-29%)

Costco (COST) — 4%

First Purchased: August 24, 2020 (+65%)

Other Individual Stocks — <1%

If you would like to know more about any of the aforementioned stocks, and why I own them, then become a paying subscriber.

Cash - 2%

The cash is strictly referring to cash available to trade.

Separate of my investment portfolio, I keep 6-months worth of living expenses in an emergency (high-yield) savings account.

Recent Portfolio Activity

Charlie Munger taught me that there are huge mathematical advantages to doing nothing.

Sold Google for a profit. My thought-process is that I am already exposed to Google through VTSAX and VOO. Furthermore, owning individual stocks is not a wise bet for the long-term. Finally, I did not value the business.

Sold Sonos and PayPal. Realized losses that were the equivalent of <0.20% of the Stock Portfolio. Holding on to them any longer may have been Disposition Effect.

Overlooked Risk Factors

My concentration is Apple is technically greater than 11% when you consider that it is the largest weighted holding in both VOO and VTSAX.

e.g. Apple is 7.67% of Vanguard’s VOO

Alibaba’s home country brings risk. I plan to hold until 2030.

Some would argue that my portfolio could benefit from more international exposure.

Next Steps

I have a cash position that equals 2% of the Stock Portfolio.

The most rational decision is to fund the passive indexing strategy i.e. buy more VOO.

However, it would be fun to keep that cash in case I uncover a reasonably-priced, compounding machine.

Other investments Not Mentioned Here

I own real estate. I also investing in Venture-Backed Startups.

Want to know more about how I invest? Consider becoming a Paid Member.