Munger Models: Complex Adaptive Systems

"You must think in a multidisciplinary manner. You must routinely use all the easy-to-learn concepts..." -Charlie Munger

This is the second post in the “Munger Models” series, where I will provide detailed explanations of the 100+ mental models needed to use Charlie Munger’s multidisciplinary approach to thinking.

What is a Complex Adaptive System?

Have you ever wondered why the stock market behaves so unpredictably, or why certain economic theories fail to account for real-world scenarios?

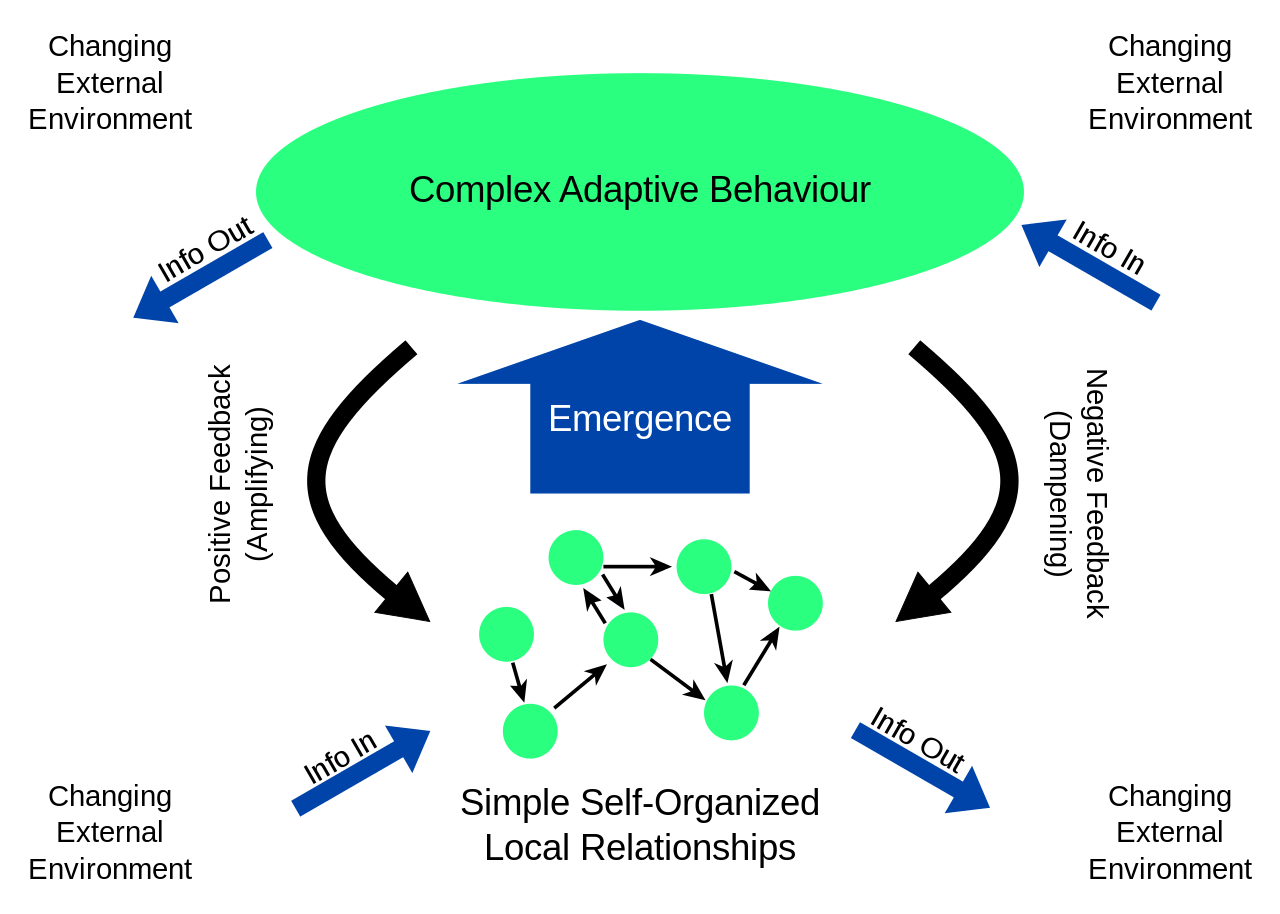

A complex adaptive system (CAS) is dynamic, consisting of individual components that interact, adapt, and self-organize in response to external changes. This results in the system's behavior being unpredictable when merely examining its individual parts.

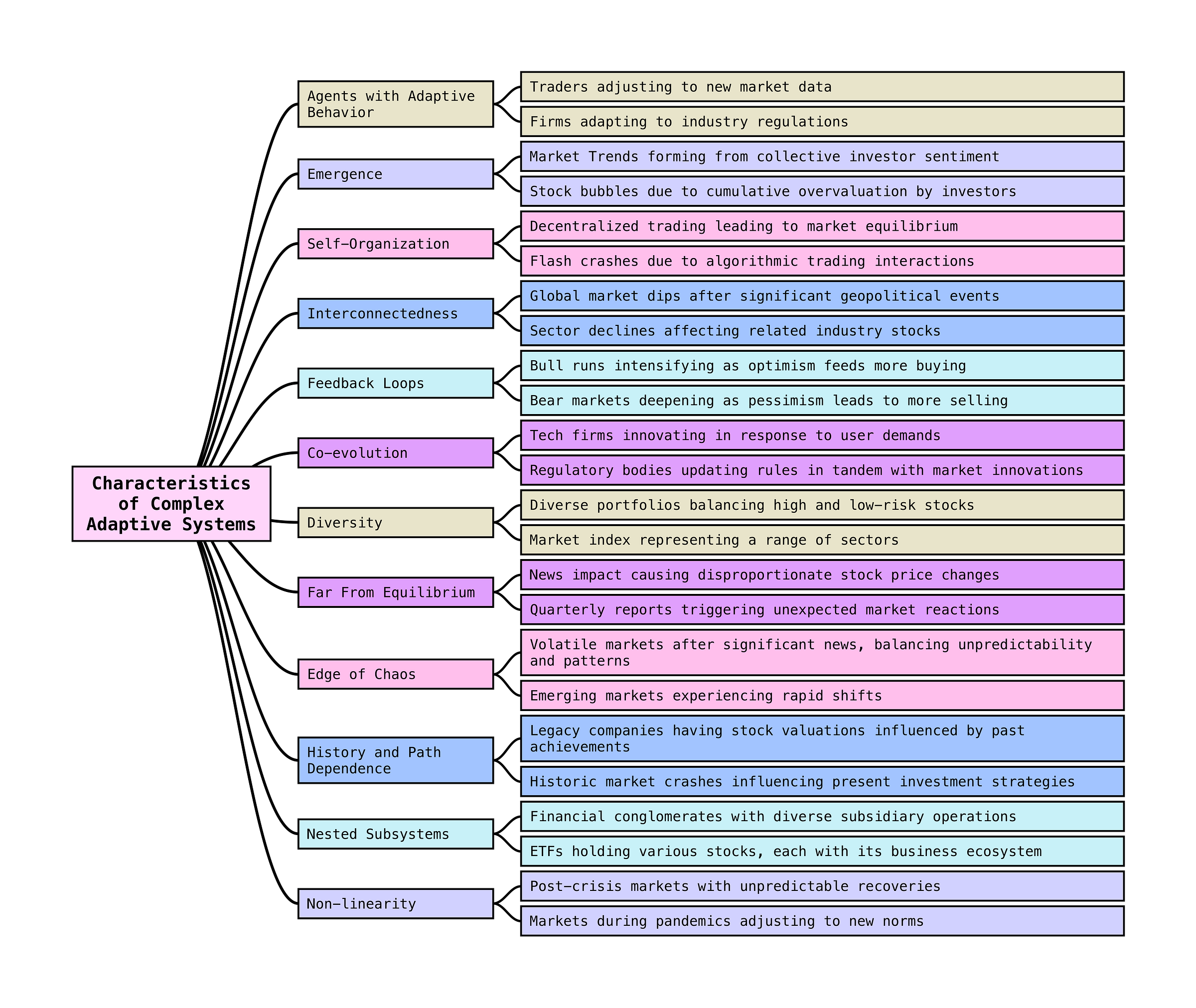

I created the illustration (below) to highlight CAS characteristics in context of investing.

Remember These 3 Things

The discovery of complex adaptive systems fundamentally changed how we think about economics, the stock market, and much more.

The stock market is an example of a complex adaptive system. It consists of multiple agents (investors, traders, institutions) that interact based on individual strategies, goals, and information. Their collective decisions result in the emergent behavior of the market — stock prices going up or down, market booms, and busts.

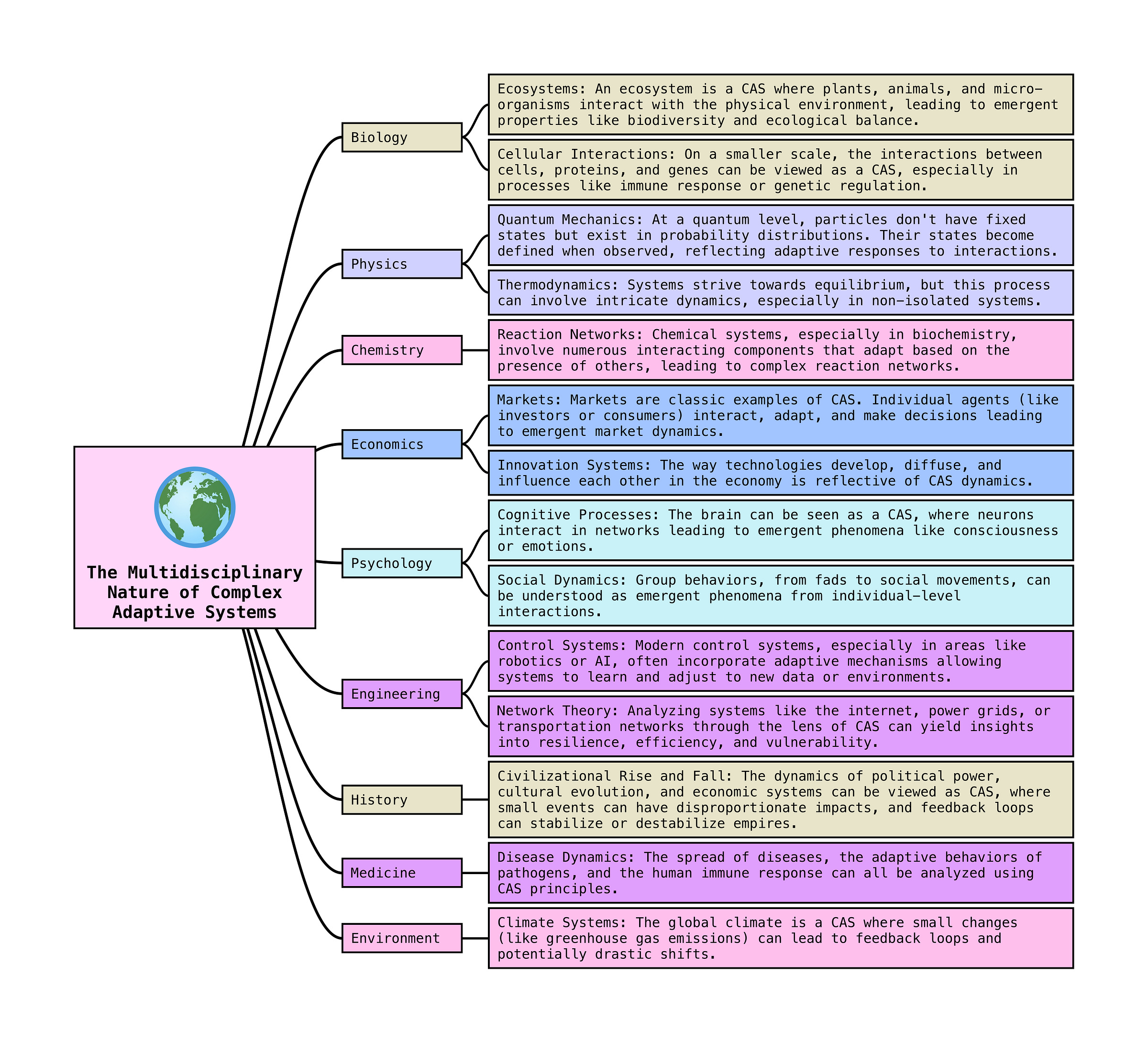

CAS concepts can be applied to understand and analyze the dynamics, behaviors, and interactions within these a wide variety of disciplines i.e. Biology, Physics, Chemistry, Economics, Psychology, Engineering, History, Medicine, and in our Environment.

Please see the illustration below for more details.

How Can We Use This Model?

Viewing the stock market as a complex adaptive system offers a cognitive advantage as investors. Consider the fictional story of two identical twins, Bill and Gil:

Bill adopts a linear system view. He believes that by studying past market trends meticulously, he can forecast future stock market movements accurately. He frequently adjusts his investment strategy based on his predictions, leading him to incur frequent transaction costs and sometimes make hasty decisions.

Gil understands the market as a complex adaptive system. He doesn't waste energy trying to predict specific market events like interest rate hikes or stock market crashes. Instead, he focuses on long-term investment strategies, understanding the nature of CAS and the unpredictability that comes with it. Over time, Gil's approach is less stressful, incurs fewer transaction costs, and often yields better returns because he's not reacting impulsively to perceived market trends.

Please reference the table below for more details.

As an investor, understanding the stock market as a CAS can prevent costly mistakes like over-extrapolating past trends. As Howard Marks aptly put it:

“Now that investing has become so reliant on higher math, we have to be on the lookout for occasions when people wrongly apply simplifying assumptions to a complex world."

Uncovering Wisdom from Charlie Munger

During a session at the Daily Journal Meeting, Charlie Munger highlighted the evolving nature of complex systems:

…if you’re dealing with a complex system, the rules of thumb that worked in the complex system in year 1 may not work in year 40…The laws of physics you can count on, but the rules of thumb in a complex civilization changes as the civilization changes.

Take note of Munger’s mention of the laws of physics. It’s part of a large conversation around people having “physics envy” i.e. smart people seeking physics-like precision outside of the realm of physics

In 2003, Charlie Munger made the following point as it relates to economics:

“Economics should emulate physics’ basic ethos, but its search for precision in physics-like formulas is almost always wrong in economics."

🌎 How the World Really Works

In complex adaptive systems, relying solely on historical norms can be misleading because these systems are perpetually adapting and evolving.

I was reminded of something I read in Howard Marks’ book, The Most Important Thing, that offers more details:

“Markets change, invalidating models. Accounts of the difficulties of “quant” funds center on the failure of computer models and their underlying assumptions. The computers that run portfolios attempt primarily to profit from patterns that held true in past markets. They can’t predict changes in those patterns; they can’t anticipate aberrant periods; and thus they generally overestimate the reliability of past norms.”

Understanding complex adaptive systems is crucial for various fields because they offer insights into how to manage, influence, or design such systems effectively.

Recognizing the essence of complex adaptive systems aids us in making more grounded and informed decisions in a world teeming with intricacies.

Non-linearity is a hallmark of the real world.

Complex systems, like financial markets, defy simple causality.

Every event has multiple potential causes, and pinpointing their exact impact remains elusive, even in hindsight.

Limitations of This Model

Recognizing the presence of complex adaptive systems alone doesn’t make it easy to solve problems. You still have to do the work.

Conclusion

Complex Adaptive Systems (CAS) provide a valuable framework that highlights the interconnected, dynamic, and evolving nature of systems. Understanding the nature of CAS teaches us that:

Non-linearity is a hallmark of the real world.

Complex systems, like financial markets, defy simple causality.

Every event has multiple potential causes, and pinpointing their exact impact remains elusive, even in hindsight.

Cause-and-effect thinking is out-dated and rarely useful for investors.

By appreciating the intricacies of CAS, we position ourselves better to navigate a world brimming with complexities and unpredictabilities, making more informed and holistic decisions.

Previous Model: Regression to the Mean

👇 I dedicate hours to making valuable content for you. The best way to say ‘thanks’ is to Like and Share. I appreciate it!