CMQ Investors,

We put together a compilation of mental tricks that Charlie has referenced over the years. They are simple, powerful, and I believe you will benefit from using them.

I stumbled into a few mental tricks early in life, and I just use them over and over again. —Charlie Munger

1. Figure Out What Works & Do It

I’m using this trick for CMQ Investing. Specifically, I read all the feedback you provide via this Typeform survey. It tells me what CMQ content is most useful for you. Then, I make more content like that.

I’d say we’re demonstrating what might be called the fundamental algorithm of life: Repeat what works. —Charlie Munger

👉 Did You Know: One of Charlie Munger’s heroes is Lee Kuan Yew. The next two quotes are both in reference to the founding Prime Minister of Singapore.

And [Lee Kuan Yew] said one thing over and over and over again all his life. “Figure out what works, and do it.” If you just go at life with that simple philosophy…you will find it works wonderfully well. —Charlie Munger

[Lee Kuan Yew’s] method for doing it was so simple. The mantra he said over and over again was ‘figure out what works and do it.’ Now it sounds like anybody would know that made sense, but you know most people don't do that. They don't work that hard at figuring out what works. —Charlie Munger

2. Solve Problems Using Inversion

This is the trick of all Charlie Munger tricks. The idea comes from algebra. We dedicated an entire episode of our podcast to Inversion.

👉 Try this: Figure out what causes the opposite of what you want. Write them down. Avoid those things.

There are all kinds of tricks that I just got into by accident in life. One is, I invert all the time. I was a weather forecaster when I was in the Air Corp…So I figured out the men that I was actually making weather forecasts for: real pilots. I said, "How can I kill these pilots?" That's not the question that most people would ask, but I wanted to know what the easiest way to kill them would be, so I could avoid it. And so, I thought it through in reverse that way, and I finally figured out. I said, “There are only two ways I'm ever going to kill a pilot." I said, "I'm going to get him into ‘icing’ his plane can't handle, and that will kill him. Or I'm going to get him someplace where he's going to run out of gas before he can land." I just was fanatic about avoiding those two hazards.”

—Charlie Munger

👉 Remember This: There are algebra problems that are easy to solve if you invert the and nearly impossible to solve if you do not.

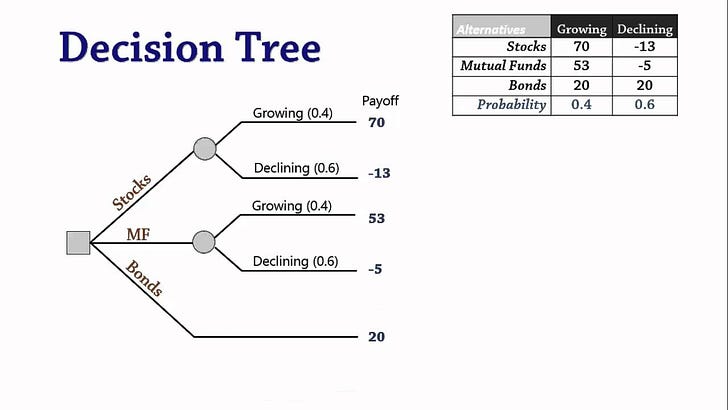

3. Think In Terms of Decision-Trees

Decision-tree theory, like inversion, is made possible by taking a basic idea from algebra and applying it to real-life problems.

At Harvard Business School, the great quantitative thing that bonds the first year class together is what they call decision-tree theory. All they do is take high school algebra and apply it to real life problems. And the students love it. They are amazed to find that high school algebra works in life...By and large, as it works out, people can’t naturally and automatically do this…So you have to learn. If you don’t get this elementary, but mildly unnatural, mathematics of elementary probability into your repertoire, then you go through life like a one-legged man in an ass-kicking contest. You are giving a huge advantage to everybody else. One of the advantages of a fellow like Buffett, is that he automatically thinks in terms of decision trees and the elementary math of permutations and combinations. —Charlie Munger

4. Use Opportunity Cost as a Filter

I would argue that one filter that’s useful in investing is the simple idea of opportunity cost. —Charlie Munger

Opportunity cost is a huge filter in life. If you’ve got two suitors who are really eager to have you, and one is way the hell better than the other, you do not have to spend much time with the other. And that’s the way we filter stock buying opportunities. —Charlie Munger

📚 Related Reading: The Charlie Munger Guide To Opportunity Cost

5. Grab Ideas From Every Discipline

I always tried to grab the really big ideas in every discipline. Because, why piddle around with the little ones and ignore the big ones. Just all the big ideas in every discipline are just very, very, very useful. Frequently, the problem in front of you is solvable if you reach outside the discipline you’re in and the idea is just over the fence. But if you’re trained to stay within the fence you just won’t find it. I’ve done that so much in my life it’s almost embarrassing…But, it’s so much fun to get the right idea a little outside your own profession. So if you’re capable of doing it, by all means learn to do it.” —Charlie Munger

🎧 Related Podcast: The Multiple Mental Models Approach To Investing

All this applies to personal relationships as well

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e