Warren Buffett, Cathie Wood, and the Tesla Valuation Debate

Decoding the Mathematics Behind Tesla's Predicted $5 Trillion Market Cap

Greetings from New York City! My name is Chris Franco, and this is CMQ Investing. If it’s your first time here, hit the subscribe button below to join 5,000+ long-term investors and never miss an update again.

Today’s post discusses one of my favorite Warren Buffett quotes about valuing companies and how it applies to Cathie Wood's recent prediction that Tesla's market cap would reach approximately $5 trillion by 2027.

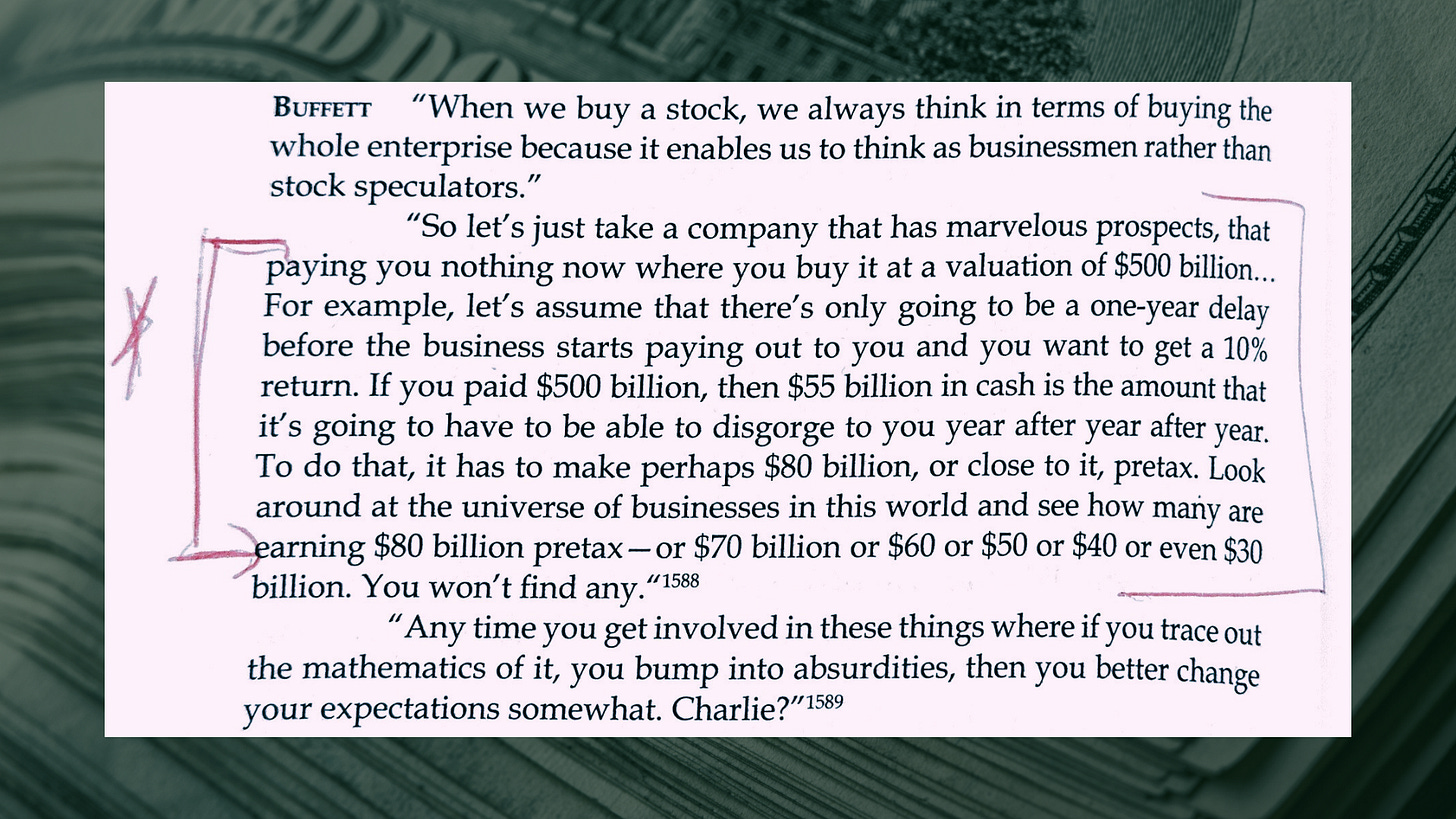

Warren Buffett once said, "So let's just take a company that has marvelous prospects, that paying you nothing now where you buy it at a valuation of $500 billion...For example, let's assume that there's only going to be a one-year delay before the business starts paying out to you and you want to get a 10% return. If you paid $500 billion, then $55 billion in cash is the amount that it's going to have to be able to disgorge to you year after year after year. To do that, it has to make perhaps $80 billion, or close to it, pretax. Look around at the universe of businesses in this world and see how many are earning $80 billion pretax - or $70 billion or $60 or $50 or $40 or even $30 billion. You won't find any. Any time you get involved in these things where if you trace out the mathematics of it, you bump into absurdities, then you better change your expectations somewhat…"

Recently, Cathie Wood predicted on CNBC that Tesla's market cap would reach approximately $5 trillion by 2027.

This raises the question: under what conditions does it make sense to buy Tesla—or any business—for $5 trillion?

To recover a $5 trillion investment within ten years, a business would need to generate $500 billion in cash each year on average, without reinvesting it back into the company (time value of money excluded for simplicity). This translates to a pre-tax income of ~$630 billion, assuming a corporate tax rate of 21%. However, no publicly traded businesses currently earn more than $630 billion pre-tax.

Tesla's annual net income for 2022 was $12.6 billion, far from the required $630 billion. To reach Cathie Wood's price target, Tesla would have to continue expanding its market share for EVs, improve profit margins, successfully launch new products and services like the robo-taxi fleet, seize the global Robo-Taxi opportunity, and keep competitors at bay.

Speaking of profit margins, the Tesla conversation included the note that Tesla’s margins are shrinking, not expanding.

While these goals are possible, as investors, we must focus on high-probability events.

Tesla already overcame significant hurdles to reach its current position, and I have a great deal of respect for Elon Musk and the Tesla team for doing their part to make it happen.

Although Tesla's achievements are impressive, and Cathie Wood's enthusiasm is appreciated, we must be rational.

A $2,000 share price prediction implies significant growth in net income and cash generation, which would require nearly perfect conditions and execution. It's important to remember that competition is increasing, and Tesla's technological edge may not be as sustainable as it appears today.

Several models cast doubt on Tesla's chances to reach Wood's predicted valuation by 2027. For instance, a company experiencing rapid earnings growth may revert to the mean, and some of Tesla's success may be due to randomness. Additionally, changing market conditions can impact Tesla's trajectory. As I remind people on my team, when talking about machine learning models: If the conditions change, everything changes.

To achieve Cathie Wood’s predicted valuation, Tesla would need near-perfect execution of its business plan, which is not guaranteed.

We should heed Warren Buffett's advice: be rational and objective when making investment decisions. And one way you can do this is by avoiding mathematical absurdities.

Videos to watch, related to this article:

1. Cathie Wood makes her Tesla price prediction on CNBC.

2. CMQ (YouTube) on Cathie Wood’s Coinbase Price Prediction

I dedicate considerable time and energy into creating this content for you. If you found it useful, please help me out by clicking the like button and sharing this article.

Did You Know: CMQ Investing was ranked among the Top 1% of all Spotify podcasts in 2022? See below for more details. Thank you for all of your support!

I put these links here for you to enjoy:

► Listen to CMQ Investing on Spotify: https://spoti.fi/3AE7jGe

► Listen to CMQ Investing on Apple: https://apple.co/3wt3cKz

► Follow Chris Franco on Twitter: https://twitter.com/chrisfranco

► Follow my Charlie Munger page on Instagram: https://bit.ly/charlie-munger-quotes

► Follow my Warren Buffett page on Instagram: https://bit.ly/warren-buffett-videos

Hi Chris, I digress, you could read WSJ through PressReader for free if you are a member of a library. It is worth your while to look into it.