Damn Right! Behind The Scenes With Berkshire Hathaway Billionaire Charlie Munger

Investing Book Notes #003

Dear CMQ Investors,

I’ve read every Charlie Munger book. Damn Right! Behind The Scenes With Berkshire Hathaway Billionaire Charlie Munger does the best job of illustrating Charlie Munger the person, not just the stoic billionaire who sits next to Warren Buffett at every Berkshire Hathaway shareholder meeting. Not only is it packed with wisdom about life, but it is also an enjoyable tale of a life well-lived.

I believe we took the book notes to the next level with this post. If you find value in the content, please subscribe:

🔑 Key Takeaway: If you never stop learning, you will never stop rising.

Damn Right! is an illustration of why Charlie is so adamant about continuous learning. In every chapter of his life, Charlie learned something that helped him perform better in the next chapter of his life. His self-made billionaire status is the result of a lifetime of compounding; both compounding money, and knowledge.

Lessons Learned Along The Way

These lessons are ordered by the stage of life when Charlie learned them.

👦 Learning life principles from his grandfather

“Charlie lived by the principles he’d learned at his grandfather’s knee—first, the surest way of building a business is by concentrating on the world already on his desk, and second, by underspending his income and amassing a pile of cash that could be invested to build future wealth."

📚 Learning physics at the University of Michigan

Although Charlie only took one introductory level class, it was the physicist’s approach to problem-solving that made a lifelong impression on him.

“The tradition of always looking for the answer in the most fundamental way available—that is a great tradition, and it saves a lot of time in the world.”

♣️ Learning business lessons by playing poker in the Army

“Playing poker in the Army and as a young lawyer honed my business skills,” said Charlie. “What you have to do is learn to fold early when the odds are against you, or if you have a big edge, back it heavily because you don’t get a big edge often. Opportunity comes, but it doesn’t come often, so seize it when it does come.”

⚰️ Learning to cope with personal tragedy as a young father

Charlie Munger lost his nine year-old son to leukemia. Charlie was 29 at the time and also going through a divorce.

Munger believes that by coping the best he could with the tragedy of Teddys’s death, he was doing the only rational thing. “You should never, when facing some unbelievable tragedy, let one tragedy increase to two or three through your failure of will.”

📺 Watch this video to hear Charlie talk about the importance of staying cheerful even when things are bad.

⚖️ Learning valuable investing lessons while practicing law

The 13 years Charlie practiced law exposed him to a number of businesses. The lessons he learned shaped his investment philosophy and altered the course of Berkshire Hathaway.

Additionally, Charlie began to realize that buying high quality businesses has certain advantages: “It’s not that much fun to buy a company that you hope liquidates at a profit just before it is destined to go broke.”

🏗 Learning something about himself through real estate development

After leaving his law practice, Charlie was into real estate development. This is how Charlie became rich. Charlie’s real estate ventures helped him discover a lifelong passion — architecture:

Furthermore, in the process of development, Charlie discovered that he had the soul of an architect. He had vision and a passion that translated itself into durable and live-able spaces.

When Charlie donated $200 million to USC for new housing, his one demand was that the school followed his design. Yes, you read that correctly. Charlie Munger designs dormitories.

Warren Buffett’s right-hand man Charlie Munger announced Thursday that he is donating $200 million to UCSB for state-of-the-art student housing, tripling the record gift he gave the school a year and a half ago.

Exactly what the dorms will look like remains unclear; Munger indicated he is only willing to donate the money if his design is followed.

🍫 Lessons learned from buying See’s Candy

I enjoyed the chapters focused on specific investments, like See’s Candy. The purchase of See’s Candy was one of the first business deals that Charlie Munger and Warren Buffett did together.

The success of See’s Candy taught Munger and Buffett that it was reasonable to pay higher prices if they were getting a better business.

Without the See’s Candy experience, Munger and Buffett would have not become prolific investors in Coca-Cola.

…I’m not sure we would have bought the Coca-Cola if we hadn’t bought the See’s.

—Charlie Munger, 2017 Berkshire Hathaway annual shareholder meeting

📺 Watch this video to better understand the See’s purchase and hear Charlie reiterate the key takeaway from the book: being willing to keep learning can make you a fortune.

Enjoy this 40% discount on your paid membership.

Fun Facts about Charlie Munger

💰 Charlie never cared about being a billionaire. He just wanted independence like his hero Benjamin Franklin.

When he first joined the military, Munger was an ordinary soldier, and his training gave him time to think about his future. “As a private in the Army in Utah in a tent, in the mud and snow—very unpleasant conditions—I remember talking to someone. I said I wanted a lot of children, a house with lots of books, enough money to have freedom.”

🎭 Charlie is playing a character on-stage at the Berkshire meetings.

“But the guy you see sitting next to Warren, that isn’t Charlie. That’s just the image he’s cultivated,” explained Munger’s stepson, Los Angeles attorney Hal Borthwick. “It’s true, probably, he doesn’t have a lot to add and he wants to get on with it. I think he works better in small groups than he does in large crowds, but at the end of the day, that isn’t the real Charlie Munger that’s suiting up there.”

😂 Charlie deliberately tried to avoid the Forbes list.

…the 76-year-old Munger said it was his goal to stay just below the wealth-level required to be named to Forbes’s list of richest Americans. It would help him stay just outside the limelight.

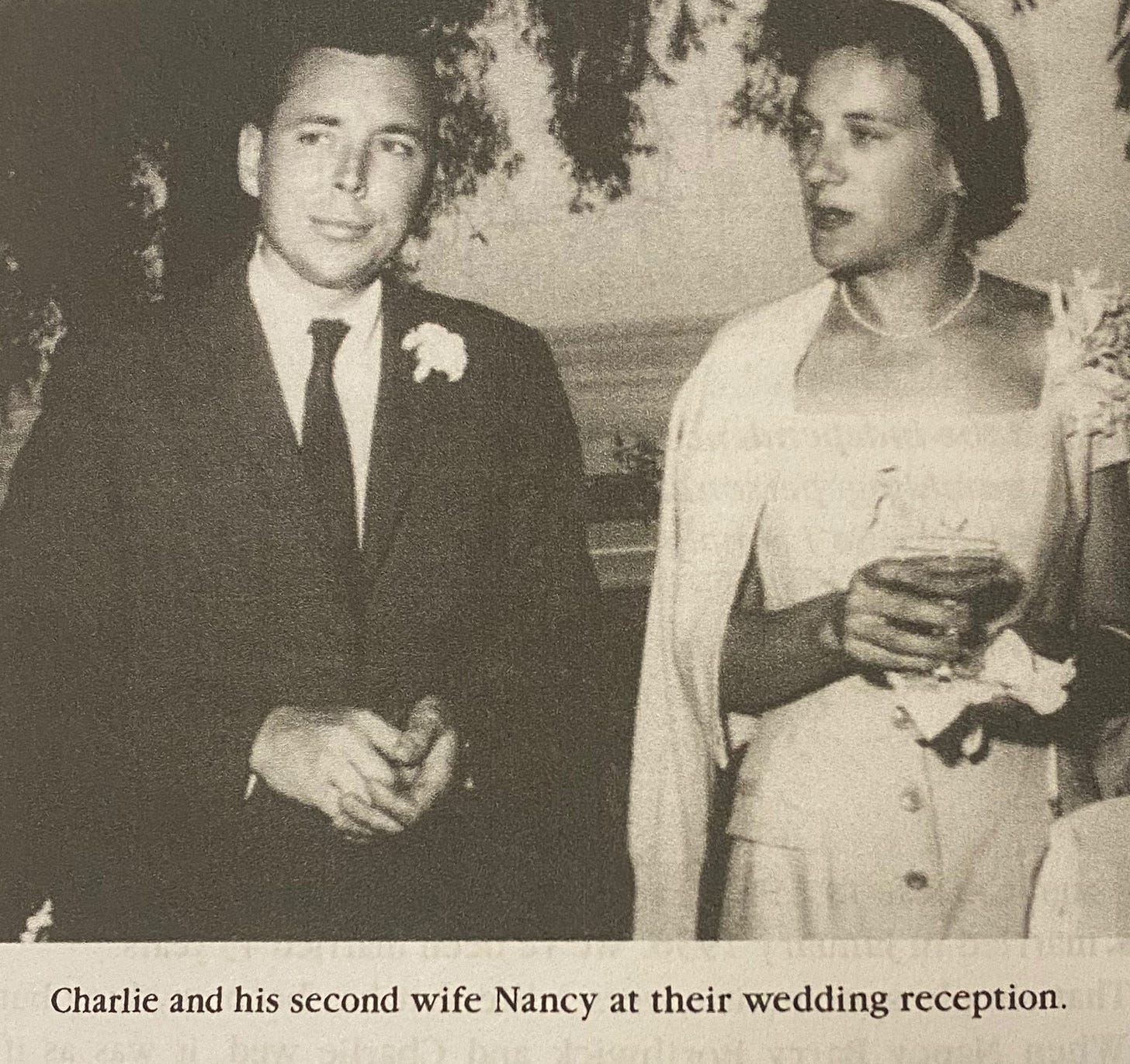

🔑 Charlie preaches patience, but was not always patient.

His wife, Nancy, describes a young Charlie as a “young man in a hurry” to live a full life and get rich.

🎣 Charlie’s favorite pastime is fishing.

“Barry Munger explained that just as his father is a patient investor, he also is an extremely patient fisherman. “He tries to find the best technique day in and day out and will stick with that lure, or whatever, even if others on the boat are having better success with something else.”

⛴ Charlie likes wacky ideas for boats.

To boat owners and builders, Munger is a guy who is intrigued by new and offbeat ideas for watercraft, and who just might be persuaded to back a project. “My dad is a pushover for anyone with a wild idea for a boat,” said his eldest daughter Molly.

Applying the big lesson to your life

I want to conclude with the following excerpt from Damn Right!, as it illustrates Charlie Munger’s success formula:

As his law career was phasing out, Munger discarded the elements from his life that no longer worked for him, and built upon those he found valuable.

If you follow Charlie Munger’s speeches and interviews then you know he has had a lifelong obsession with figuring out how things work. Continuous learning works when you apply what you learn. This is key.

What works? Why? Do more of it.

What doesn’t work? Why? Do less of it.

And never stop asking why.

More Book Notes:

More About Damn Right!

When Warren Buffett's partner, fellow Nebraskan and Berkshire Hathaway vice-chairman Charles T. Munger (now 76 years old) was a young boy, his hero was the independent Robinson Crusoe. As he grew older, he strove (and still strives) to emulate the creative thinker Benjamin Franklin, whom Munger admires most for his commitment to social causes and philanthropy. (Munger is one of the pioneering supporters of Planned Parenthood.) Lowe, who spent three intensive years learning about Munger's life and work, had the full cooperation of his subject for this biography and access to his vast network of admiring and devoted business associates, his family and his lifelong friends. She does a superb job of re-creating Munger's development from a respectable lawyer to a savvy investor, providing intricate details about the incisive thinking behind his business deals, which she weaves into a captivating narrative. The droll, brilliant, focused and intensely private Munger conducts his business the way he lives his life: he invests his time and his money in people of strong moral character and businesses that are intrinsically sound. He is not averse to risk, because he calculates it carefully, and, most crucially, when he makes a commitment, he does so for the long term.