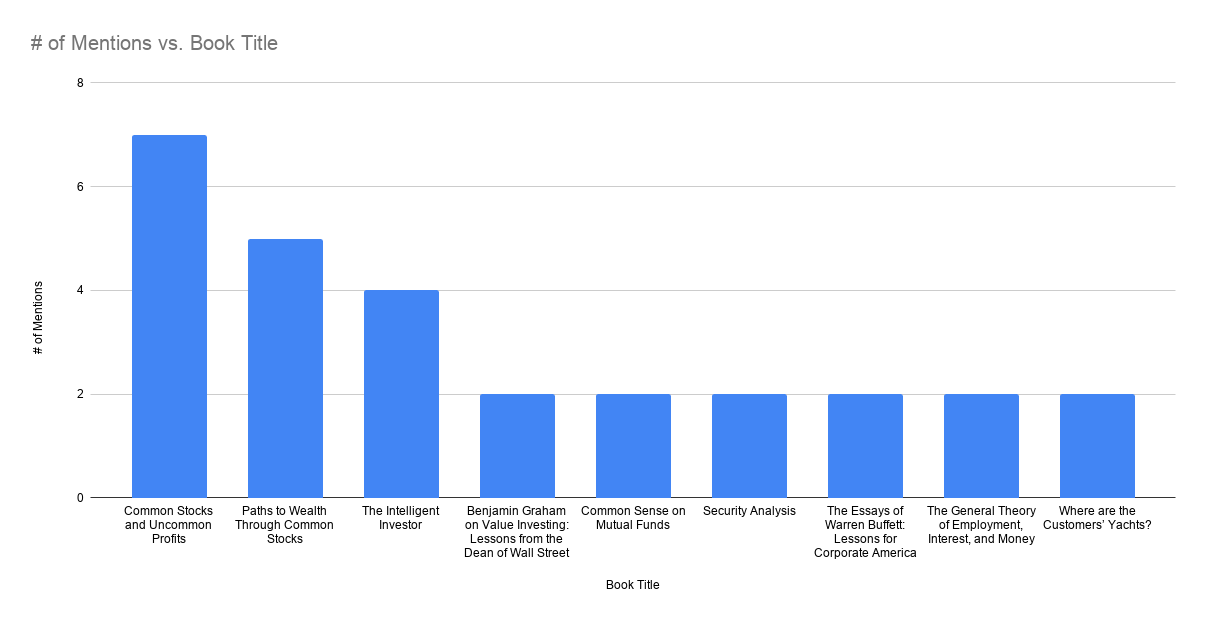

7 Investing Books Warren Buffett Recommended More Than Once

We did the research. Here is what we uncovered.

Dear CMQ Investors,

Warren Buffett recommended 31 books at the Berkshire Hathaway annual shareholder meetings, dating back to 1994. What are the books Buffett recommended more than once? We did the work. Here is what we uncovered.

If you follow @charliemungerquotes and @warrenbuffettvideos on Instagram, then you will love our newsletter. Subscribe to never miss an update.

📚 Seven books Buffett recommended more than once

📖 Common Stocks and Uncommon Profits

Buffett, 2017:

I’ve mentioned this before. But one of the best books on investment was written, I think, in 1958. I think I read it around 1960, by Phil Fisher, called Common Stocks and Uncommon Profits.

📖 Paths to Wealth Through Common Stocks

Buffett, 1995:

I was very influenced by Phil Fisher when I first read his two books, back around 1960 or thereabouts. And I think that they’re terrific books.

Buffett, 2008:

…I read a book called The Intelligent Investor. And I did that when I was 19 down at the University of Nebraska. And I would say that if you absorb the lessons of The Intelligent Investor, mainly in — I wrote a forward and I recommended particularly Chapters 8 and 20 — that you will not behave like a lemming and you may do very well compared to the lemmings.

📖 Benjamin Graham on Value Investing: Lessons from the Dean of Wall Street

Buffett, 1994:

“I recommend] Ben Graham’s biography, which will be available in September, by Janet Lowe. And I’ve read it and I think those of you who are interested in investments, for sure, will enjoy it. She’s done a good job of capturing Ben.”

CMQ Fun Fact: Janet Lowe also wrote the Charlie Munger biography.

📖 Common Sense on Mutual Funds

Buffett, 1999:

A book that came out just in the last few months in the investment world that I would certainly recommend to everybody is Common Sense on Mutual Funds, by Jack Bogle. Jack is an honest guy, and he knows the business. And if mutual fund investors listen to him, they would save billions and billions of dollars a year. And he tells it exactly like it is. So I — he asked me for a blurb on the book, and I was delighted to provide it.

Buffett, 1995:

There’s a lot of meat in there.

📖 The Essays of Warren Buffett: Lessons for Corporate America

Buffett, 2000:

Probably the best, I would say, the most representative book on my views is the one that Larry Cunningham has put together, because he essentially has taken my words and rearranged them in a more orderly — he’s taken from a number of years. And what he has put together there best represents my views.

📖 The General Theory of Employment, Interest, and Money

Buffett, 1994:

There’s one chapter in The General Theory [of Employment, Interest and Money by John Keynes] that relates to markets, and the psychology of markets, and the behavior of market participants and so on, that probably is, aside from Ben Graham’s two chapters, eight and 20, in The Intelligent Investor — I think you’ll find you’ll get as much wisdom from reading that as anything written in investments.