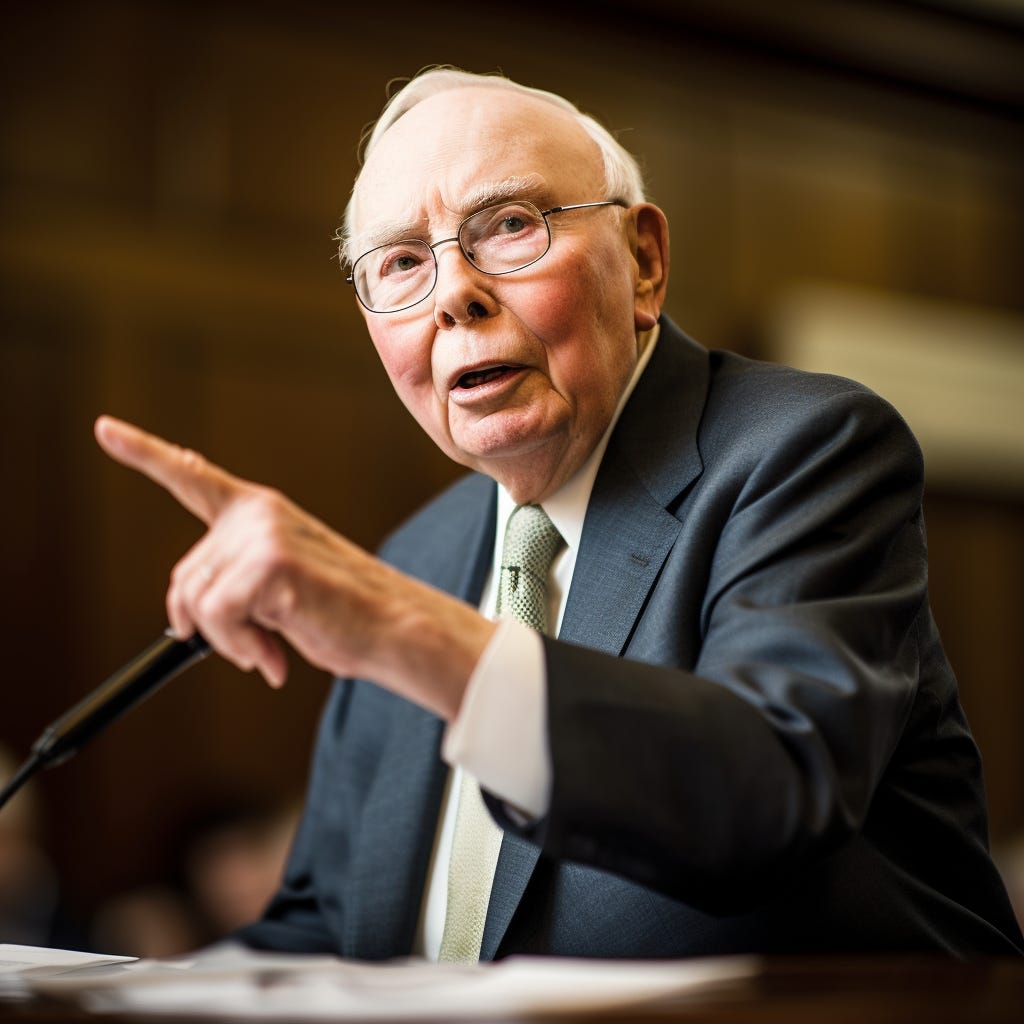

36 Quotes by Charlie Munger That’ll Make You Invest Better

Timeless Wisdom and Actionable Insights for Smart Investing

Navigating the investing world can be complex, but some timeless quotes offer clear guidance.

The essence of these quotes boils down to a few core principles: understand value, act with patience and discipline, manage emotions, and keep learning.

These principles are not only foundational for investing but are also guiding lights for leading a meaningful and successful life.

Note: Below the quotes, I’ve provided 3 actionable insights for you to consider.

36 Investing Quotes by Charlie Munger

“There are huge mathematical advantages to doing nothing.”

“It's not supposed to be easy. Anyone who finds it easy is stupid.”

“Opportunity comes, but it doesn't come often so seize it when it does.”

“Civilized people don't buy gold; they invest in productive businesses.“

“The worst thing you can do is invest in companies you know nothing about.”

“If you actually know what you're doing I think three investments are plenty.”

“I can't give you a formulaic approach [to valuing a stock] because I don't use one.”

“If you invest the way people gamble in casinos, you're not going to do very well.”

“It’s a life-long game, and it you don’t keep learning, other people will pass you by.”

“The world is full of foolish gamblers. They will not do as well as the patient investors.”

“It's waiting that helps you as an investor, and a lot of people just can't stand to wait."

“The whole secret of investment is to find places where it’s safe and wise to non-diversify.”

“The game of investing is one of making better predictions about the future than the other people.”

“You should remember that good ideas are rare. When the odds are greatly in your favor, bet heavily.”

“Just buy the one great company…at the right price and then just sit there.”

“Good investing requires a weird combination of patience and aggression. And not many people have it.”

“My Berkshire Hathaway stock cost me $16 per share, and it's now selling for almost $300,000 per share.”

“Diversification is protection against ignorance, a confession that you don't know the businesses you own.”

“I think great investors to some extent are like great chess players. They’re almost born to be investors.”

“My lesson to all of you is conduct your life so that you can handle the 50% decline with aplomb and grace.”

“If you're trying to analyze a company without using an adequate checklist, you may make a very bad investment.”

“And I think that everyone who thinks through the investment process learns more about how the world really works.”

“Why should it be easy to do something like that, if done well two or three times, will make your family rich for life?”

“I don’t think you can get to be a really good investor over a broad range without doing a massive amount of reading.”

“You do better to make a few large bets and sit back and wait. There are huge mathematical advantages to doing nothing.”

“To everyone who finds the current investment climate hard, difficult, and somewhat confusing, I would say, 'welcome to adult life.’”

“There are huge advantages for an individual to get into a position where you make a few great investments and just sit back and wait.”

“I didn't get rich by buying stocks at a high price-earnings multiple in the midst of crazy speculative booms, and I'm not going to change.”

“All intelligent investing is value investing; acquiring more than you are paying for. You must value the business in order to value the stock.”

“Generally speaking, trying to dance in and out of the companies you really love, on a long-term basis, has not been a good idea for most investors.”

“If you’re trying to do better than average, you’re lucky if you have four things to buy…Very few people have enough brains to get 20 good investments.”

“It is remarkable how much long term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

“Bull markets go to people's heads. If you're duck on a pond, and it's rising due to a downpour, you start going up in the world. But you think it's you, not the pond.”

“The [approach to] investing where you find few great companies and just sit on your [rear-end] because you've correctly predicted the future, that is what it's very nice to be good at.”

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

A lot of people with high IQs are terrible investors because they've got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.

Three Actionable Insights

1. Emphasize Patience and Inaction:

Engage in deliberate inaction when it provides mathematical advantages. As multiple quotes highlight, "There are huge mathematical advantages to doing nothing," and "It's waiting that helps you as an investor."

Action: Avoid the temptation to constantly trade or shift investments. Wait for the best opportunities and let them mature.

2. Value and Understand Your Investments:

Ensure that you deeply understand the businesses you invest in. As noted, "The worst thing you can do is invest in companies you know nothing about" and "All intelligent investing is value investing."

Action: Before investing, research and understand the intrinsic value of a company. Avoid following market hypes and trends without a solid foundation of knowledge.

3. Manage Emotions and Expectations:

Maintain emotional discipline and have realistic expectations about market fluctuations. Quotes that emphasize this include: "A lot of people with high IQs are terrible investors because they've got terrible temperaments" and "If you’re not willing to react with equanimity to a market price decline of 50%... you’re not fit to be a common shareholder."

Action: Develop emotional resilience by not letting market highs inflate your ego or market lows deflate your spirit. Remember that investing is a long-term game, and temporary fluctuations shouldn't dictate your overall strategy.

This installment of CMQ Investing is free for everyone via a weekly email. If you would also like to receive it, join the thousands of other smart people who absolutely love it today.

If you enjoyed reading this post, feel free to share it with friends! Or feel free to click the ❤️ button on this post so more people can discover it on Substack. Thank you for supporting CMQ!