14 Creative ChatGPT Prompts That May Revolutionize the Way You Invest

CMQ Investors!

This post features 14 of my latest, original ChatGPT prompts. I have been literally obsessed with ChatGPT so I hope you find something valuable/interesting/useful from this post. If not, then I need to re-evaluate my life choices. :)

I’ve already hit the “email length limit” otherwise I would include more than 14 of my ChatGPT Prompt experiments. I have an idea, though…

If this post is well-received (likes, shares, new subs), I will happily share more of my creative prompts in the coming days.

Let’s become AI-driven investors…

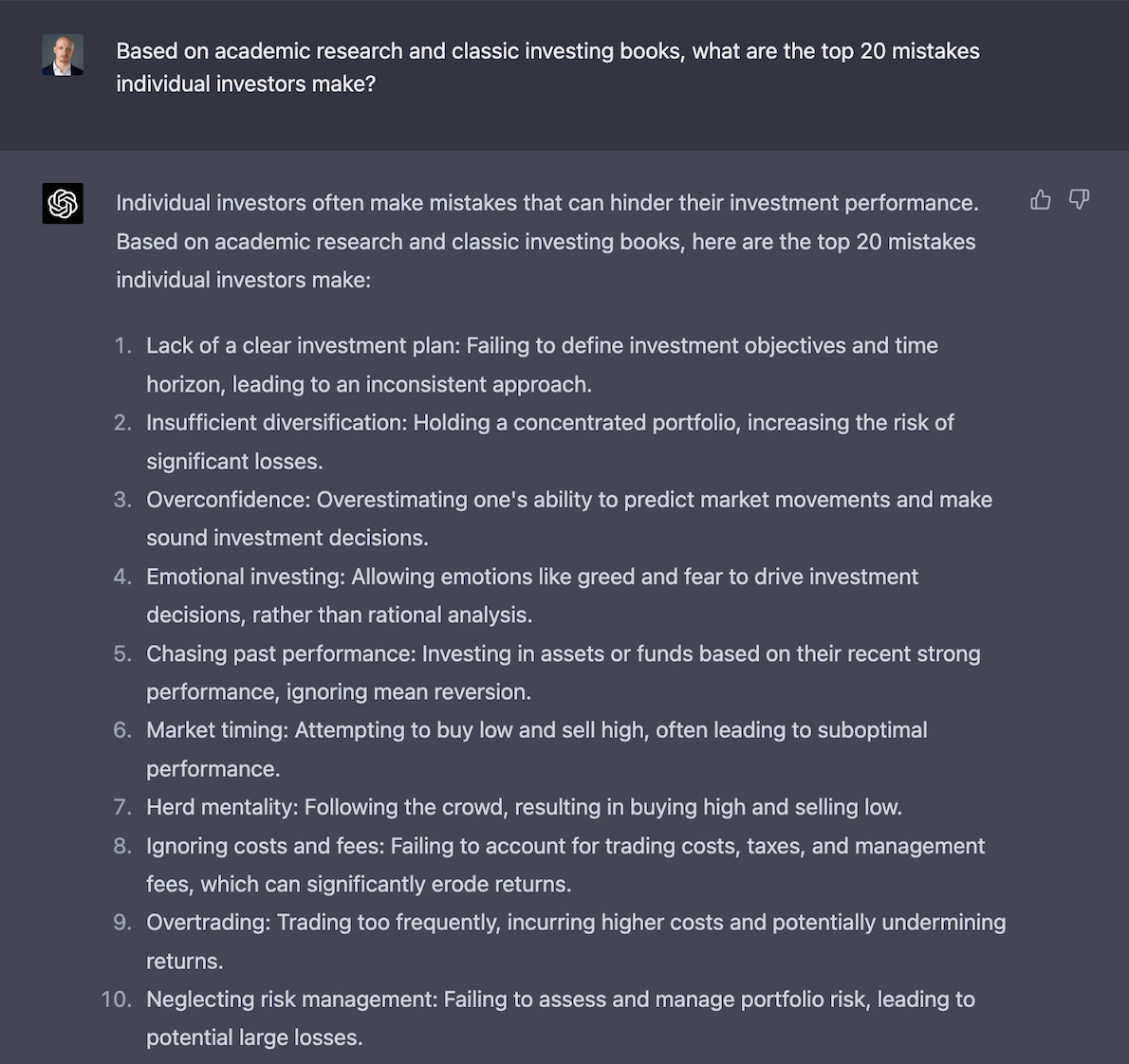

Prompt #01: Learn from the mistakes of other investors, as documented in academic research and classic investing books.

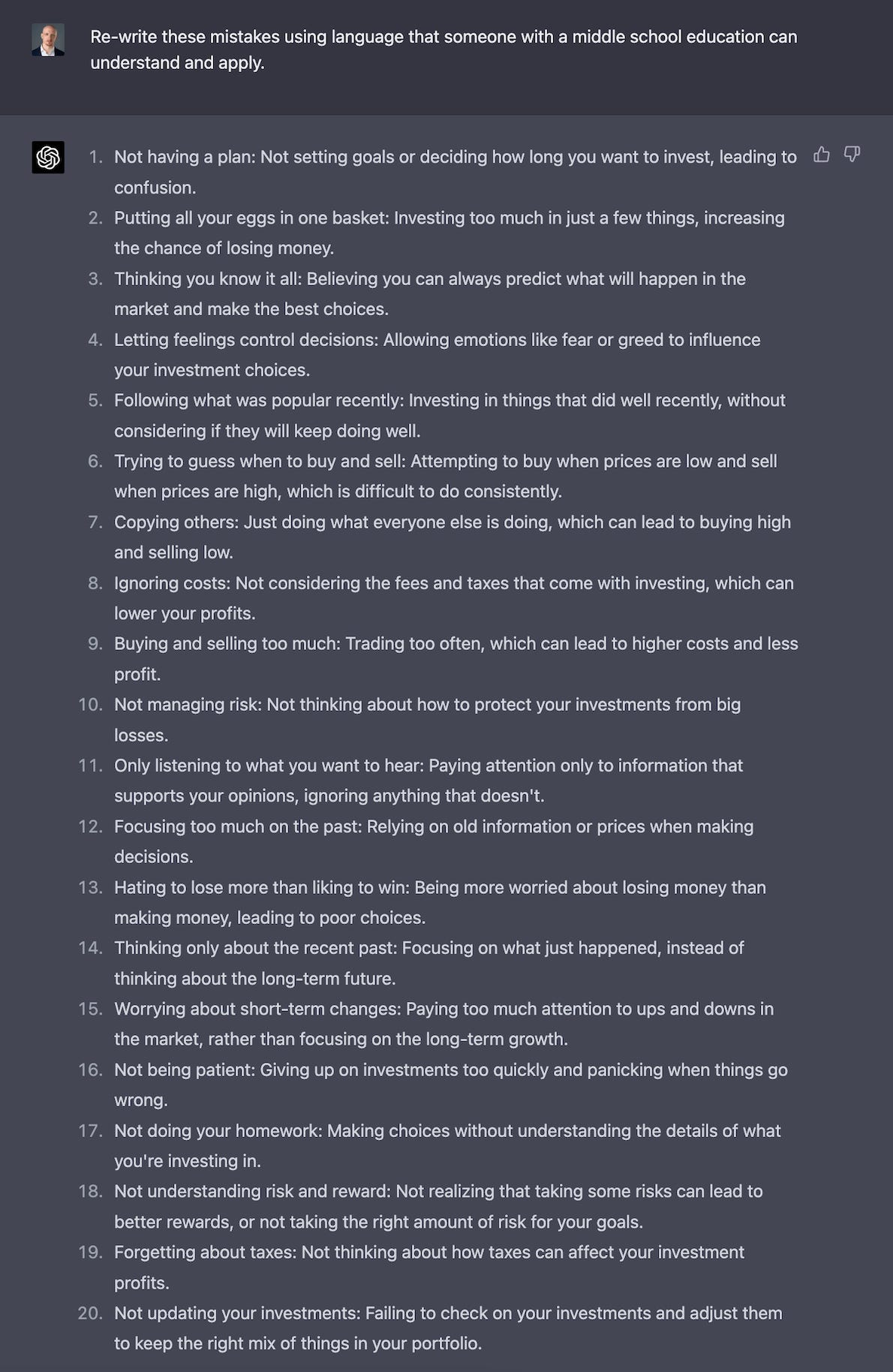

Prompt #02: Then, have ChatGPT re-create the response using language that someone with a middle school education can understand.

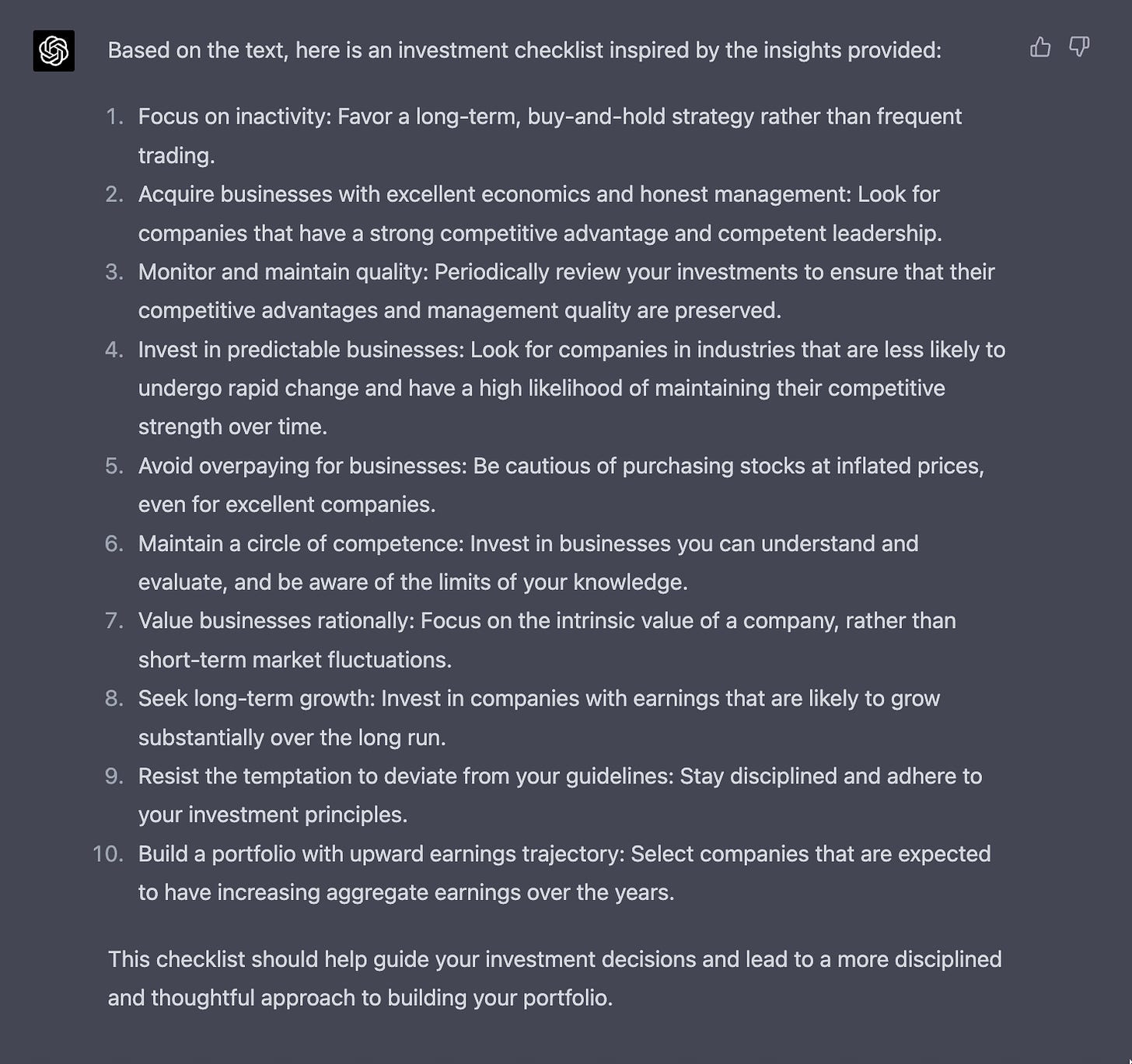

Prompt #03: Transform your favorite Warren Buffett wisdom into an investment checklist. Here’s what I did with one of my favorite passages from the 1996 letter to shareholders.

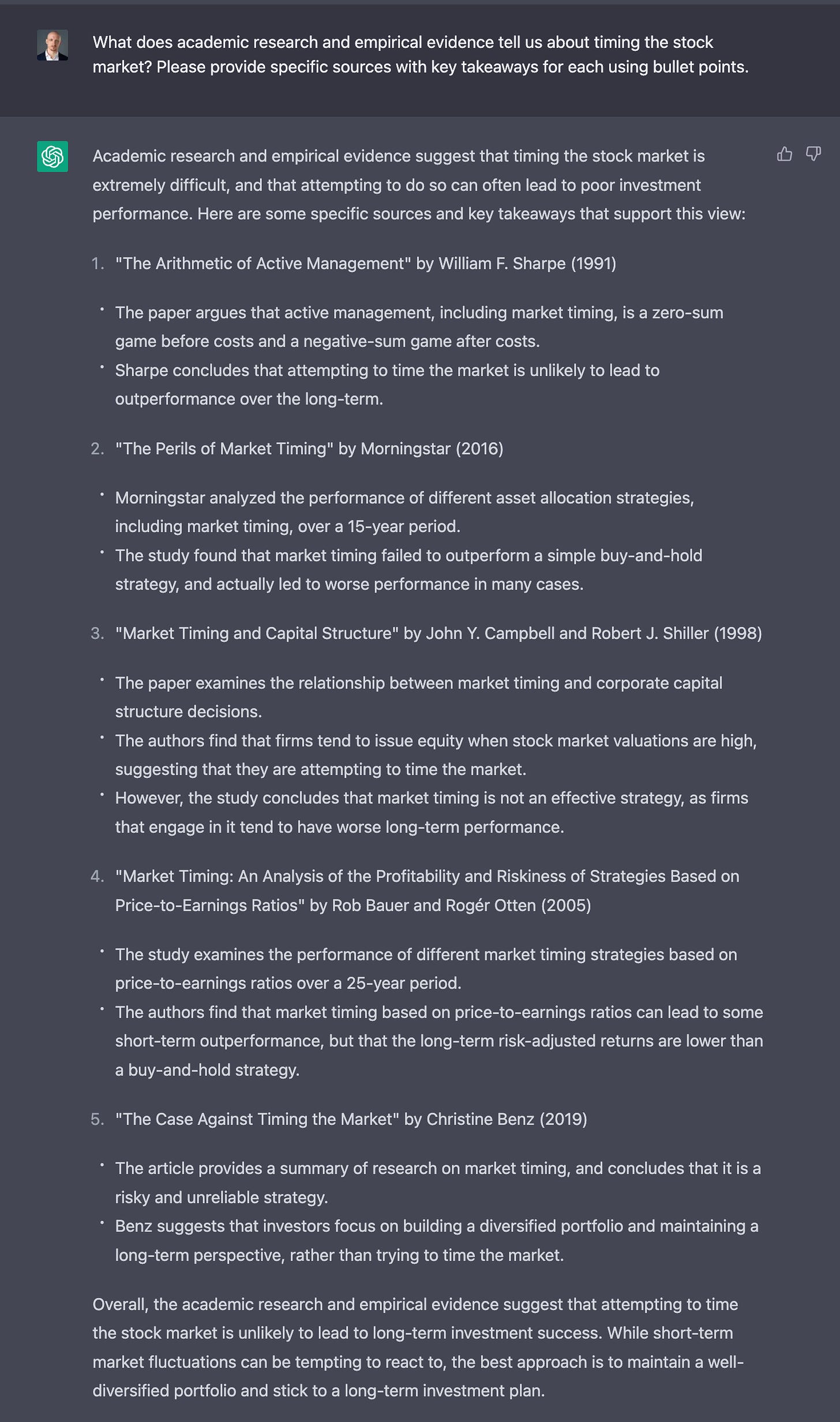

Prompt #04: Stress-test your favorite (or least favorite) investing ideas with empirical evidence.

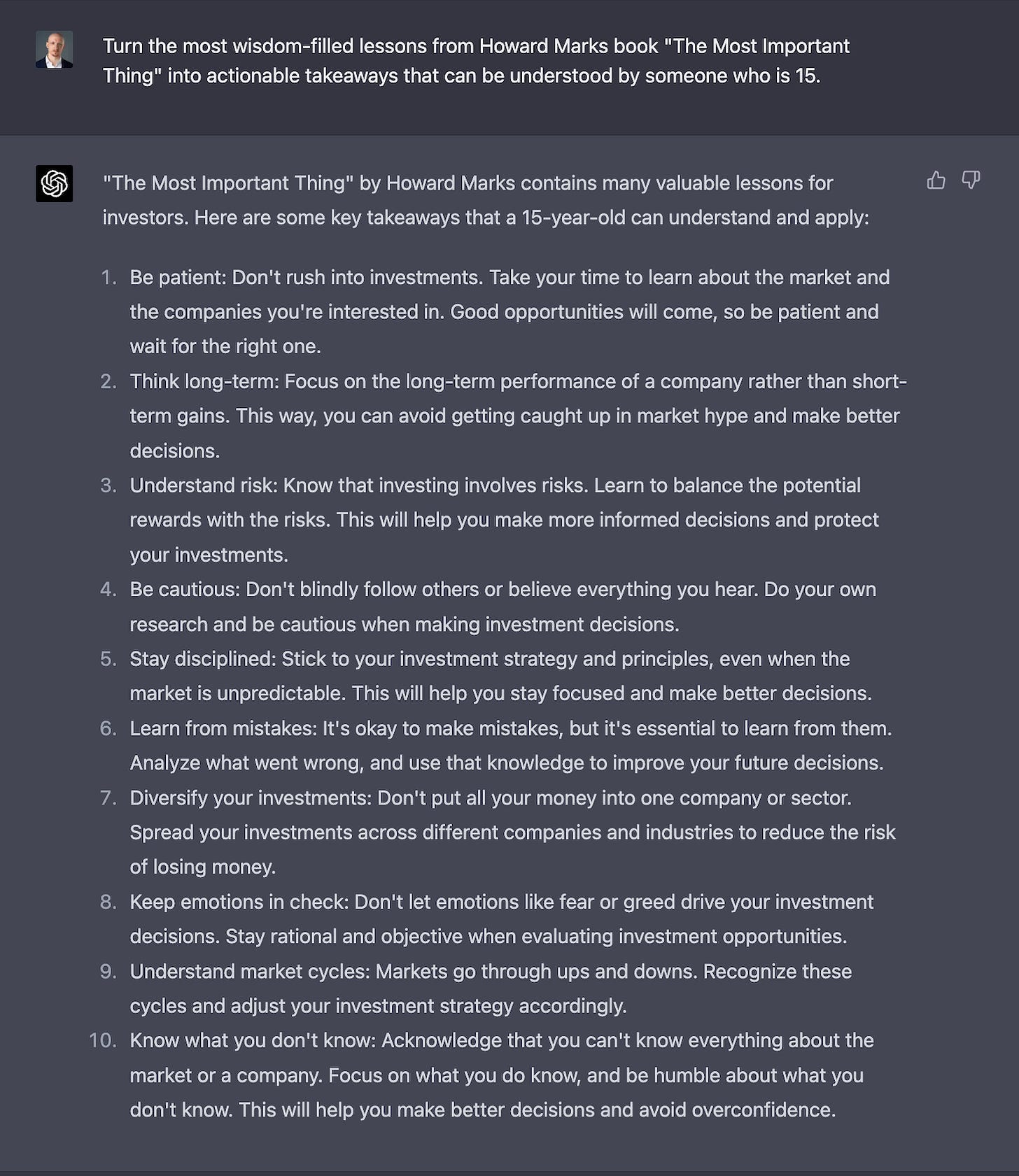

Prompt #05: Learn the most important takeaways from a modern classic like “The Most Important Thing” by Howard Marks and make sure it can be understood by a 15 year-old.

Prompt #06: Have Warren Buffett teach you important concepts. Here’s a taste of Buffett on the Base Rate Fallacy:

Prompt #07: Be a fly on the wall for a hypothetical conversation between Warren Buffett and the late Phil Fisher.

Warren Buffett (WB): Phil, it's always a pleasure to speak with you. One of the topics I've always admired your approach on is assessing management. I believe that the quality of a company's management is crucial in determining its long-term success.

Phil Fisher (PF): You're absolutely right, Warren. I've always emphasized that good management is a key factor in making investment decisions. So, what do you typically look for when you assess management?

WB: Well, I mainly focus on three factors: integrity, intelligence, and energy. A management team with a high level of integrity ensures that they will act in the best interests of the shareholders. Intelligence is essential for making smart decisions, and energy helps drive the company forward.

PF: I couldn't agree more. Integrity is paramount for me as well. I also like to look for a management team with a long-term vision, one that is focused on creating value for shareholders over an extended period.

WB: That's a great point, Phil. Long-term vision is crucial, and it's something that often gets overlooked. Another aspect I consider is how well the management team allocates capital. I like to see a track record of wise investments, whether it's acquisitions, organic growth, or returning capital to shareholders.

PF: Absolutely, Warren. Capital allocation is a key determinant of a company's success. In addition to that, I pay attention to a management team's adaptability. In today's rapidly changing business landscape, it's important for a company to be able to pivot and respond to new challenges and opportunities.

WB: You're right, Phil. Adaptability is essential. One more thing I like to consider is the depth of the management team. A company with a strong bench of leaders can better navigate the ups and downs of the business world.

PF: That's an excellent point, Warren. A deep management team ensures continuity and a strong succession plan. Ultimately, the quality of management can make or break an investment. By focusing on these key attributes, we can greatly improve our chances of picking winning companies.

WB: I couldn't agree more, Phil. As always, it's been a pleasure discussing investing with you. Your insights are invaluable, and I'm confident that by focusing on strong management, we'll continue to find great investment opportunities.

Prompt #08: Add a disagreeable Charlie Munger to the mix. (Hahah)

Warren Buffett (WB): Phil, it's always a pleasure to speak with you. One of the topics I've always admired your approach on is assessing management. I believe that the quality of a company's management is crucial in determining its long-term success.

Phil Fisher (PF): You're absolutely right, Warren. I've always emphasized that good management is a key factor in making investment decisions. So, what do you typically look for when you assess management?

WB: Well, I mainly focus on three factors: integrity, intelligence, and energy. A management team with a high level of integrity ensures that they will act in the best interests of the shareholders. Intelligence is essential for making smart decisions, and energy helps drive the company forward.

PF: I couldn't agree more. Integrity is paramount for me as well. I also like to look for a management team with a long-term vision, one that is focused on creating value for shareholders over an extended period.

Charlie Munger (CM): Hold on a second, gentlemen. While I agree that integrity, intelligence, and energy are important qualities in management, I think we're overlooking a key aspect here – the importance of rationality. It's not enough to have a management team with a long-term vision; they need to make rational decisions in both good times and bad.

WB: That's a valid point, Charlie. Rational decision-making is certainly a critical factor. We've seen many intelligent and energetic management teams falter due to irrational behavior.

PF: You're right, Charlie. Rationality is crucial, and we should not underestimate its importance. It's vital for management to remain level-headed and objective, especially during challenging times.

CM: Another point I'd like to make is that sometimes management can be too conservative in their approach. A company with management that is hesitant to take calculated risks may miss out on valuable opportunities for growth and innovation.

WB: That's true, Charlie. Striking the right balance between caution and risk-taking is crucial for a company's success.

PF: I agree, and it's also important to remember that even the most talented management team can't always overcome industry headwinds or macroeconomic factors beyond their control. So, while assessing management is vital, we must also consider the broader context in which the company operates.

CM: Well, I'm glad we can agree on that. A holistic approach to investing is essential, and understanding management's role within that context is crucial.

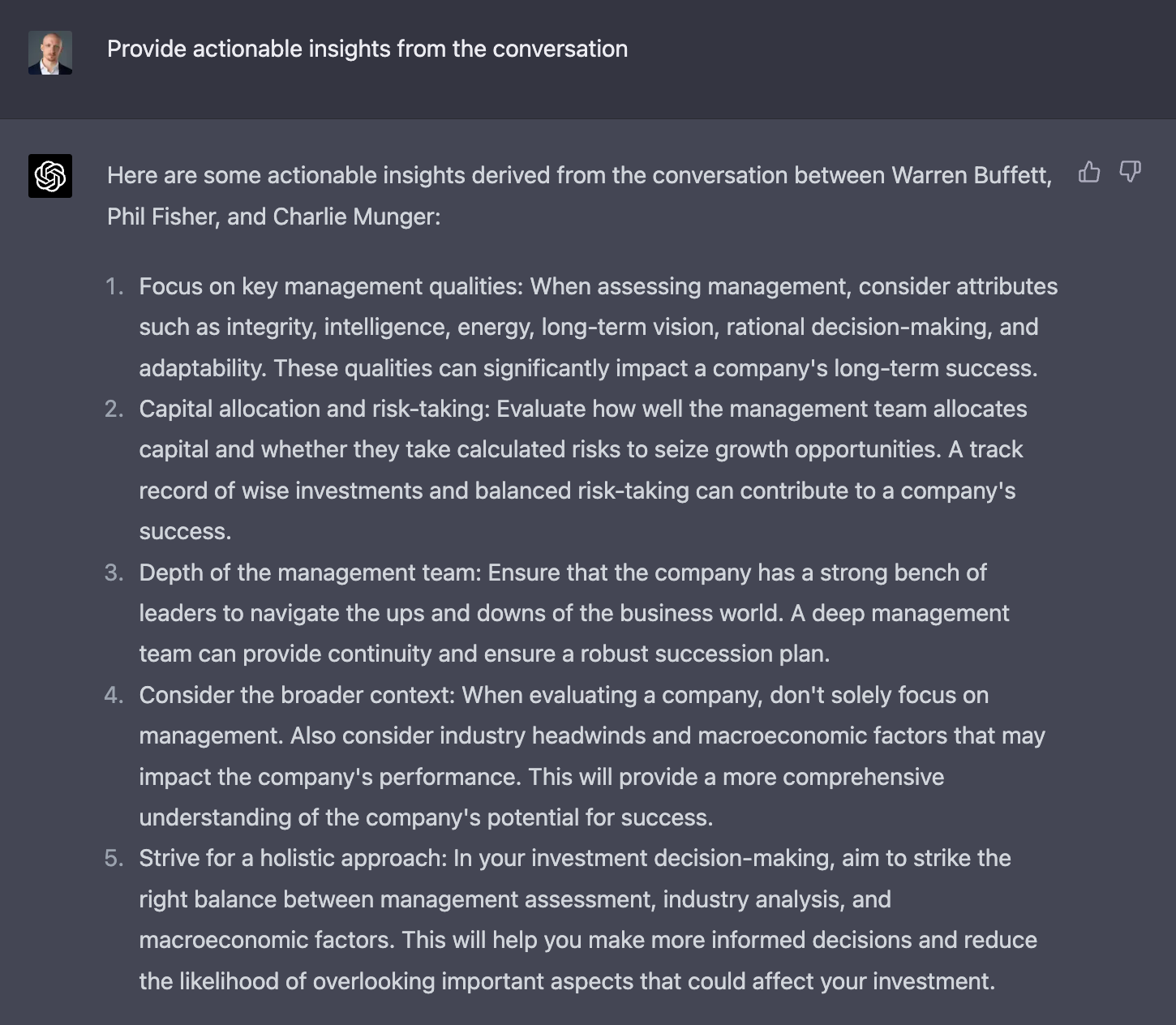

Prompt #09: Provide actionable insights from the aforementioned conversation.

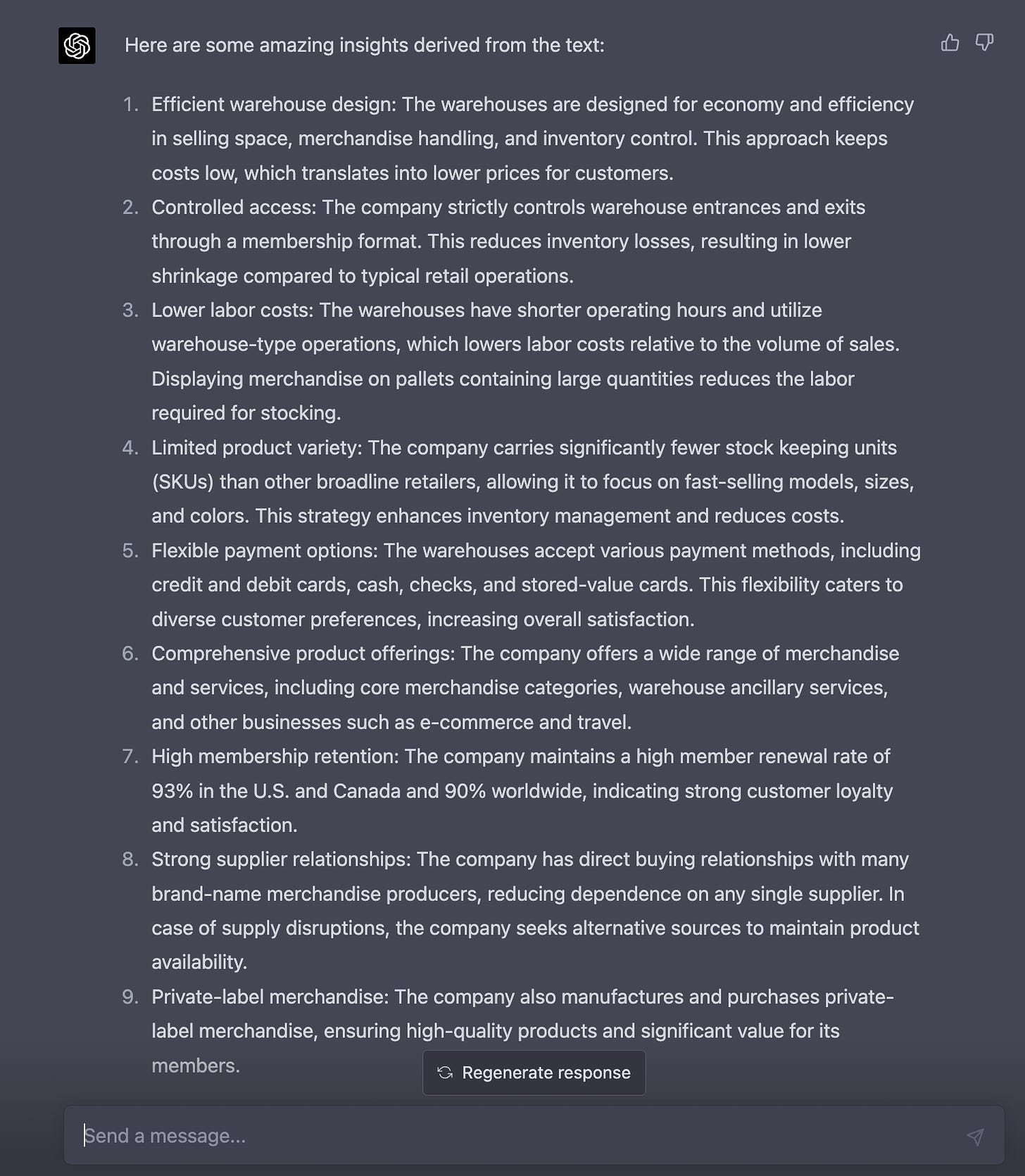

Prompt #10: Analyze 10-Ks and generate “amazing insights that no human would ever be able to see.” — Although, you would be able to see these.

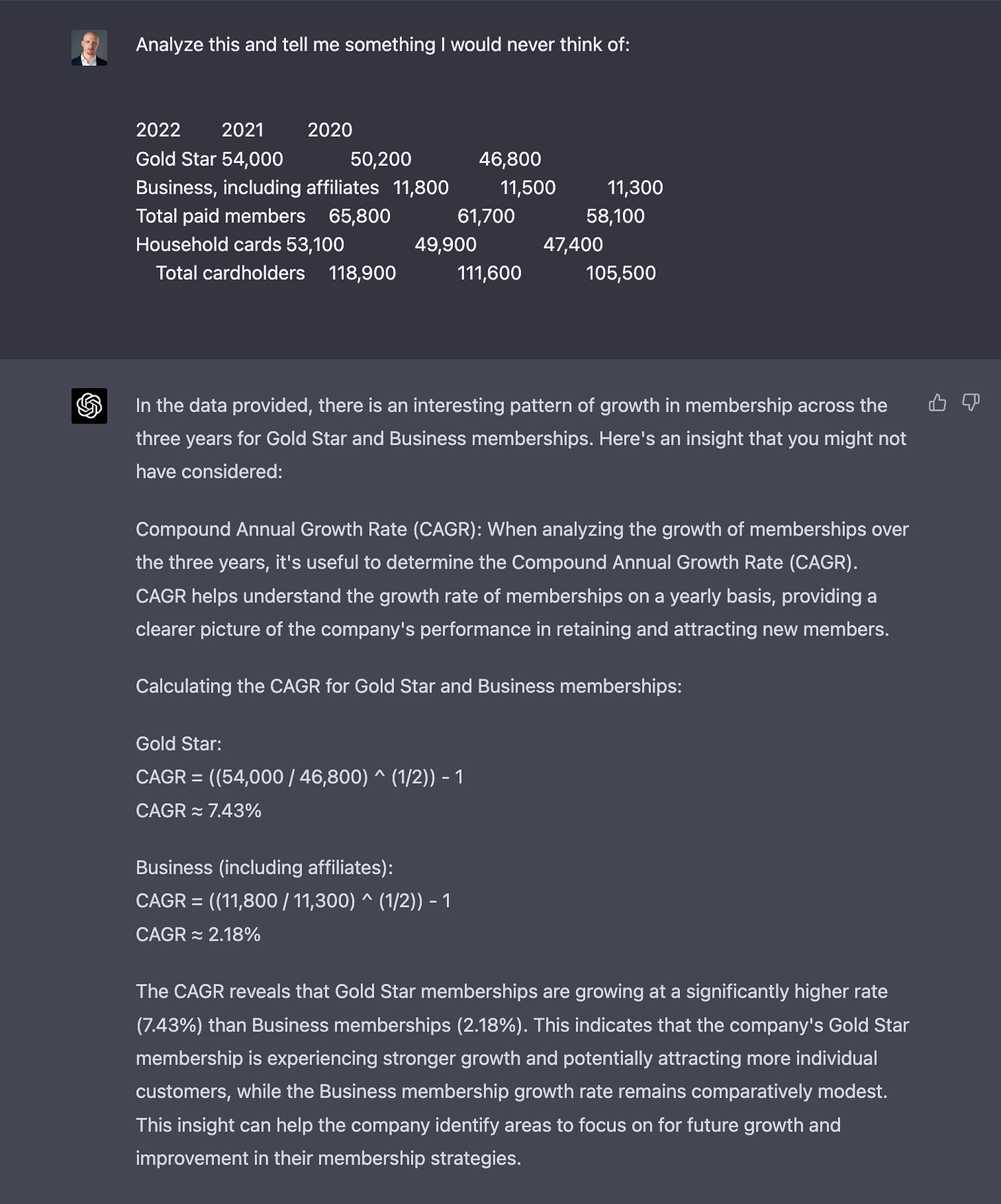

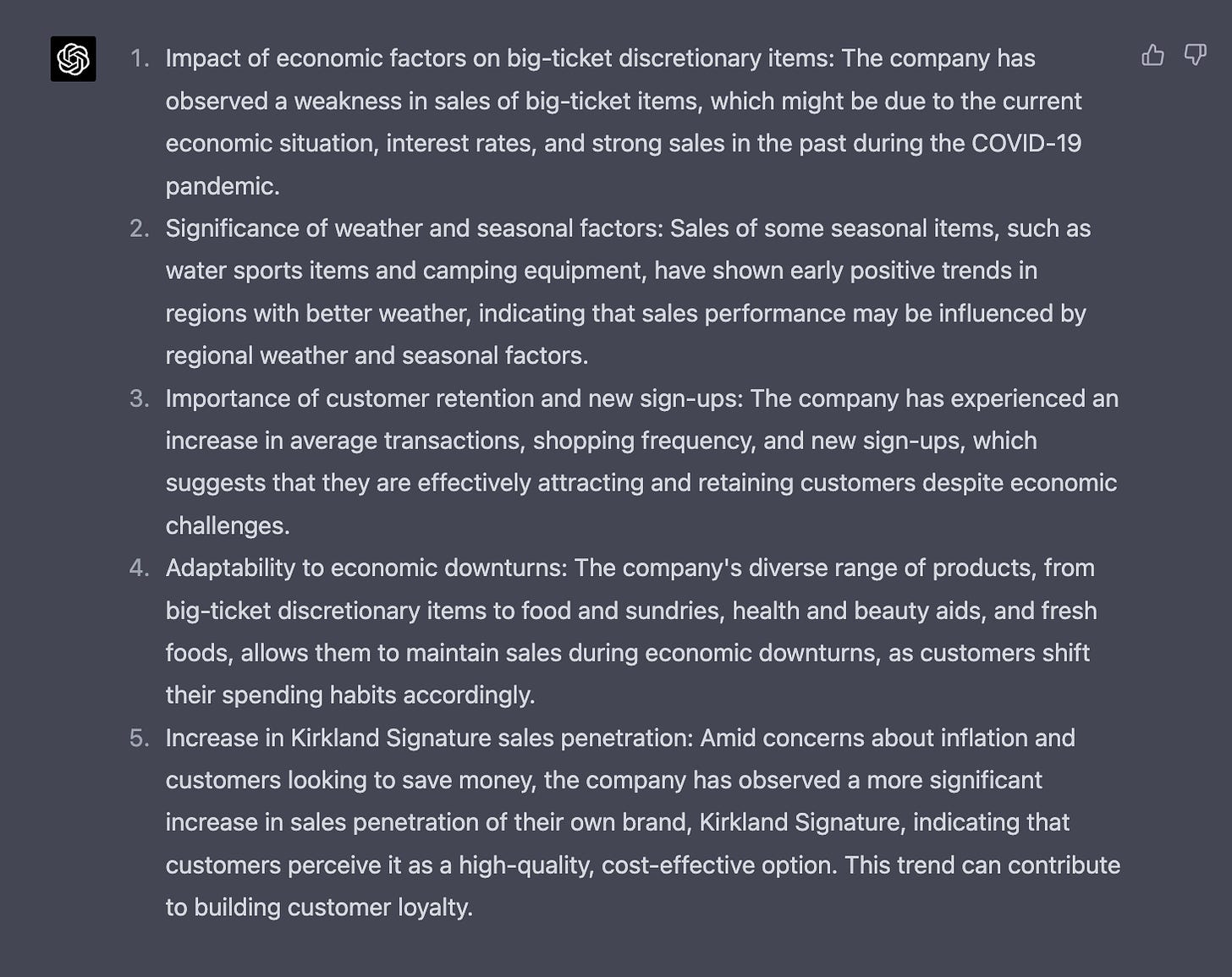

Prompt #11: Analyze random data tables from Costco’s 10-K and tell me something I would never think of — And you could probably think of this, too.

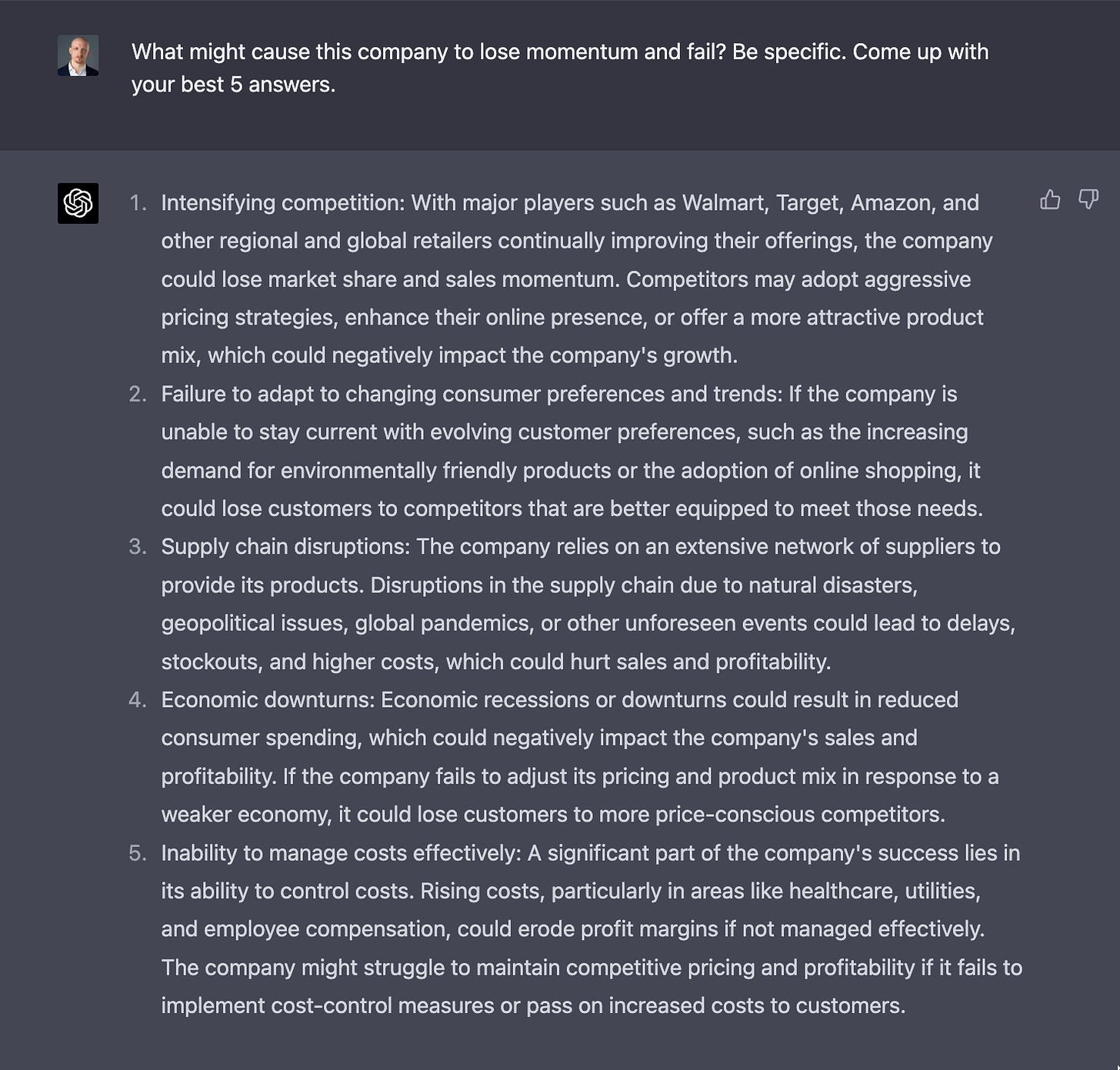

Prompt #12: Get disconfirming evidence about one of your favorite stocks. Learn the counter-point.

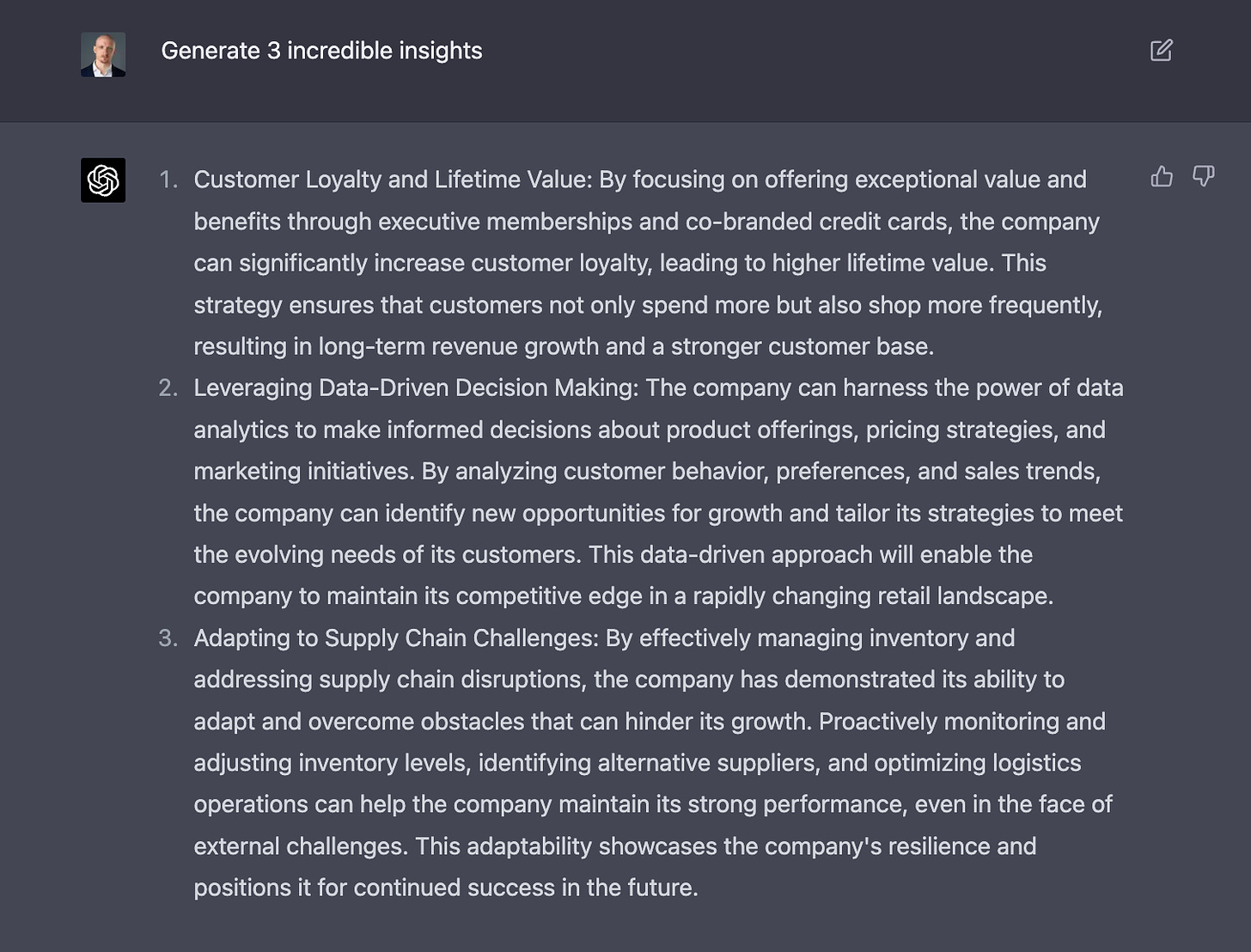

Prompt #13: Generate “incredible insights” from the Earnings Call Transcript.

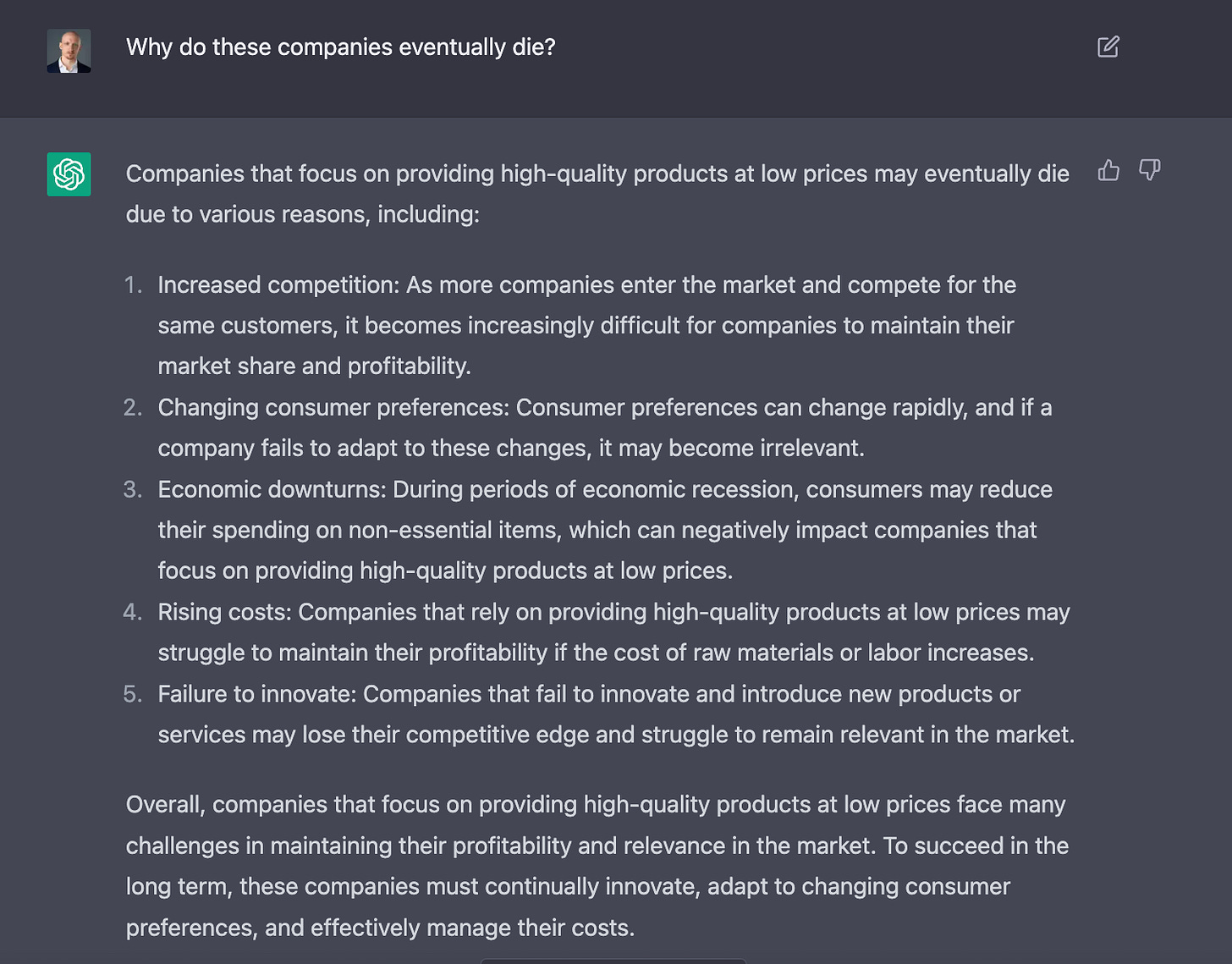

Prompt #14: Avoid capital-killing businesses.

This final prompt is one of the best as it illustrates where I personally get the most value from ChatGPT as an investor.

Costco is focused on “providing high-quality products at low prices.”

What other companies were focused on doing the same thing? What is the history of those companies? And better yet, what causes companies like that to eventually die?

As Charlie Munger famously said:

“All I want to know is where I'm going to die, so I'll never go there.”

Did You Know: CMQ Investing was ranked among the Top 1% of all Spotify podcasts in 2022? See below for more details. Thank you for all of your support!

I put these links here for you to enjoy:

► Listen to CMQ Investing on Spotify: https://spoti.fi/3AE7jGe

► Listen to CMQ Investing on Apple: https://apple.co/3wt3cKz

► Follow Chris Franco on Twitter: https://twitter.com/chrisfranco

► Follow my Charlie Munger page on Instagram: https://bit.ly/charlie-munger-quotes

► Follow my Warren Buffett page on Instagram: https://bit.ly/warren-buffett-videos